India’s growth story continues to impress, driven by robust economic trends and developing opportunities across key sectors. The nation is projected to achieve a GDP growth rate of about 6.5% in fiscal year 2024-25. While this marks a slowdown compared to 8.2% growth in fiscal 2023-24, market observers are not concerned about the nation’s long-term prospects.

Franklin Templeton sees the slowdown in 2024 as transitory, citing deferred government spending as the primary cause. Furthermore, heavy monsoon rainfall during the summer also disrupted economic activities.

“The resumption of government spending, private sector capex growth and the resilience of domestic consumption, among other factors, may help India’s economy return to normalcy in 2025,” says Murali Yerram, Portfolio Manager, Franklin Templeton Emerging Markets Equity.

Projections for India’s fiscal 2025-26 growth rank between 6.7% and 7.3%.

India’s growth and equity markets

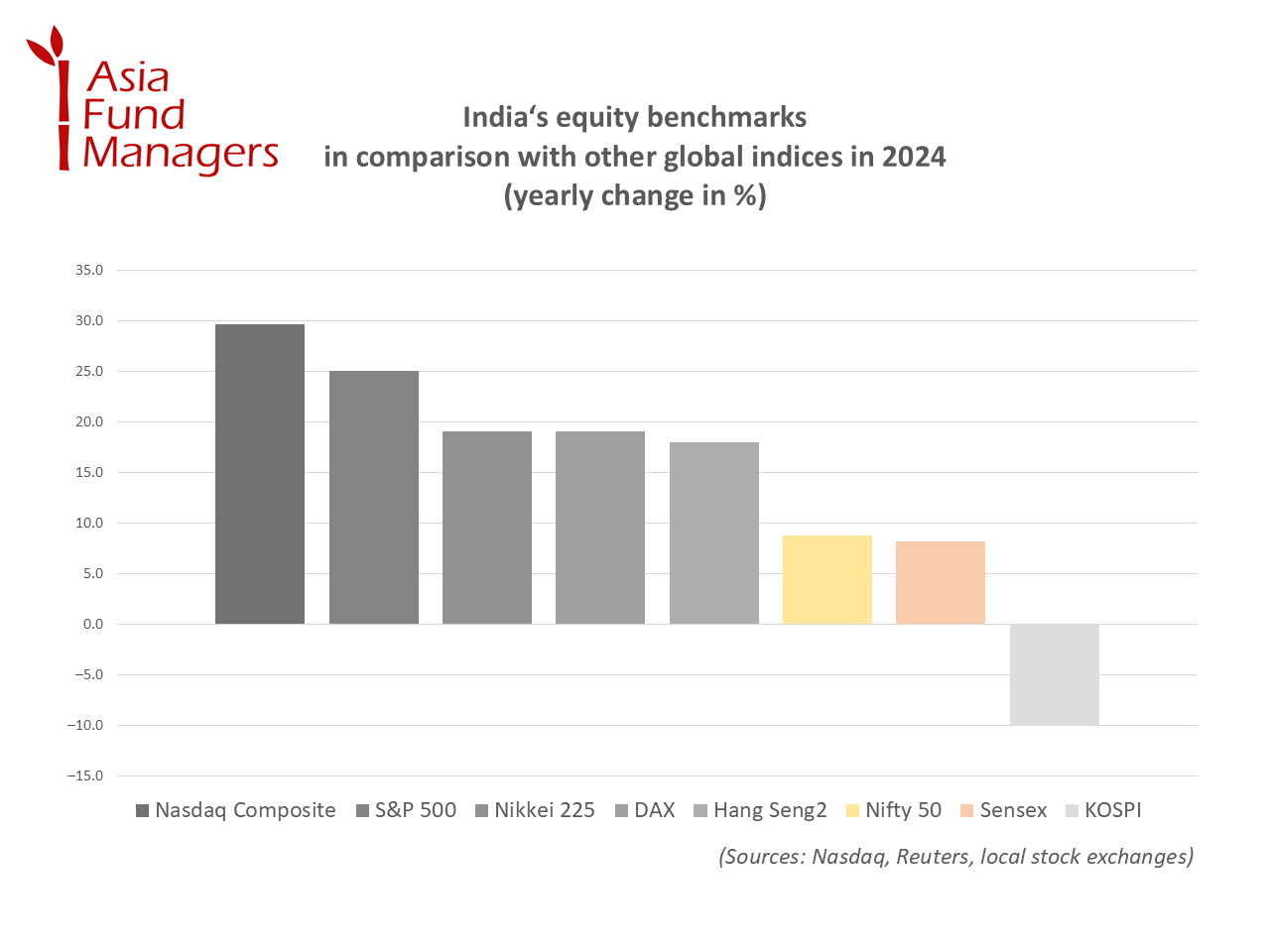

Looking at the equity markets, macroeconomic challenges and earnings pressures resulted in Indian equities underperforming some global markets last year. However, the Nifty 50 and the Sensex logged their ninth straight year of gains, with 8.8% and 8.2%, respectively.

Such continued performance underscores India’s potential as a strategic addition to global investment portfolios. And investors take note. According to the Association of Mutual Funds in India (AMFI), inflows into equity mutual funds more than doubled year-on-year to a record high of 3.53 tn rupees ($41.23 bn) last year.

“The impact of domestic factors on Indian markets outweigh that of external forces, and this growing independence from global events reinforces Indian equities’ relatively low correlation to global markets and their strategic role as a diversifier,” highlights UBS Asset Management in a recent market insight.

Their Equity Team suggests that a standalone allocation to India could enhance the risk-return profile of a global portfolio while providing greater opportunities for alpha generation over time.

UBS AM also highlights the breadth of the Indian equity market. “The investible universe has been broadening over the years, and the current balanced mix of companies big and small and from different sectors presents the right conditions for sustained alpha delivery,” the asset manager notes. “Although diverse, the market is still somewhat inefficient. Identifying mispriced stocks, especially undervalued ones, offers the potential of excess returns,” UBS AM adds.

Australia

Australia China

China India

India Indonesia

Indonesia Japan

Japan Malaysia

Malaysia Philippines

Philippines Singapore

Singapore South Korea

South Korea Taiwan

Taiwan Thailand

Thailand Vietnam

Vietnam