Korean instant noodles (ramyeon or ramyun) have taken the world by storm. The export of instant noodles reached $446.2 mn in the period from January to June, clocking in a 16.4% increase compared to the same period last year. This was a record figure. The main markets for instant noodles from South Korea include China, the US, Japan, the Netherlands, and Malaysia.

In 2022, the export of Korean ramyeon reached a record $765.4 mn, an increase of 13.5% from a year ago, according to the Korea Customs Service. Owing to the popularity of South Korean instant noodles, even the European Union decided to loosen regulations over imported instant noodle products by simplifying the safety verification process.

According to Actual Market Research, the South Korean instant food market is likely to reach $7 bn by 2028, in which Korean instant noodles will have the highest market share.

K-pop, K-drama, and the pandemic fuelled the global growth of Korean ramyeon

Ramyeon has been an integral part of Korean food culture for long, but its global spread is a result of a mix of factors. One such factor that boosted the popularity of Korean instant noodles is the Mukbang culture (live-eating broadcast) on YouTube. This trend began in South Korea in 2010 and spread globally in 2014. Lonely viewers started feeling a connection with the one eating noodles on the livestream.

Further, South Korean ramyeon products began to draw attention in 2015 due to the growing global influence of K-pop and K-dramas. Various Korean companies rushed to capitalise on the worldwide fandom for instant noodles, by manufacturing noodles, thus increasing the market size. The popularity of Korean instant noodles also reached a peak in 2020 due to the pandemic-induced lockdown as it played the role of an emergency and affordable meal.

Moreover, the rise in demand for packaged food spurred the market for instant cup noodles. The South Korean food industry is known for its innovative packaging. The cup noodles with strainers, unique sauces, and special cooking instructions were an instant hit in global markets.

Top Korean instant noodles stocks to invest

The fast-expanding global market and the growing exports of traditional flavours have benefitted the noodle makers. The rising prices of raw materials did hurt the instant food companies; however, they were quick to bounce back. Investors may consider the following stocks to invest in the South Korean instant noodles industry.

Nongshim Co., Ltd.

Nongshim is South Korea’s top instant noodle (ramyeon) maker. Headquartered in Seoul, Nongshim not only offers instant noodles but also snacks, bottled water and ready meals. The company’s products are exported to over 100 countries in the world, and it has 11 manufacturing plants.

In July, Dong-won Shin, CEO of the company said, “Nongshim will boost annual sales to $1.5 bn, threefold of the current level, by 2030 and top the U.S. ramyeon market.” Nongshim’s products got worldwide recognition after two Korean noodle varieties – Chapaguri and Neoguri – were featured in the Oscar-winning South Korean film “Parasite”.

For the year ended 31 December 2022, the company’s operating income climbed 5.7% over the year to KRW 112.2 bn ($84 mn). Additionally, Nongshim saw year-on-year revenue growth of 17.5%, totalling KRW 3129 bn ($2.35 bn).

With a market capitalisation of KRW 2.54 tn ($1.9 bn), the company is listed on the Korea Stock Exchange (KS: 004370). Its shares surged 55.7% over the past one year. Nongshim boasts a PE ratio of 13.71 and a price-to-book ratio of 0.95.

Ottogi Corporation

Headquartered in Anyang, about 20km south of Korea’s metropole Seoul, Ottogi’s product portfolio includes instant noodles, dehydrated foods, sauce, vinegar, ketchup, mayo, retro foods, frozen foods, and powdered products. The company also has a business presence in New Zealand, Vietnam, the US, and China.

At the beginning of 2023, Ottogi joined the ‘trillion won club’ and clocked in $2.43 bn in sales for the first time in history. The company has attributed much of the success to the commercial endorsement by the BTS member Jin for its Ottogi Jin Ramen.

The company saw an 11.5% year-on-year increase in its operating profit, reaching KRW 185.7 bn ($140 mn) in the full year ended December 2022. During this same period, Ottogi’s revenue witnessed a 16.2% year-on-year increase, amounting to KRW 3183.3 bn ($2.39 bn).

The company, with a market capitalisation of KRW 1.377 tn ($1.0 bn), has its shares traded on the Korea Stock Exchange (KS: 007310). Over the past year, the Ottogi stock has experienced a 20.22% decline. The company boasts a price-to-earnings ratio of 7.11 and a price-to-book ratio of 0.70.

Samyang Foods

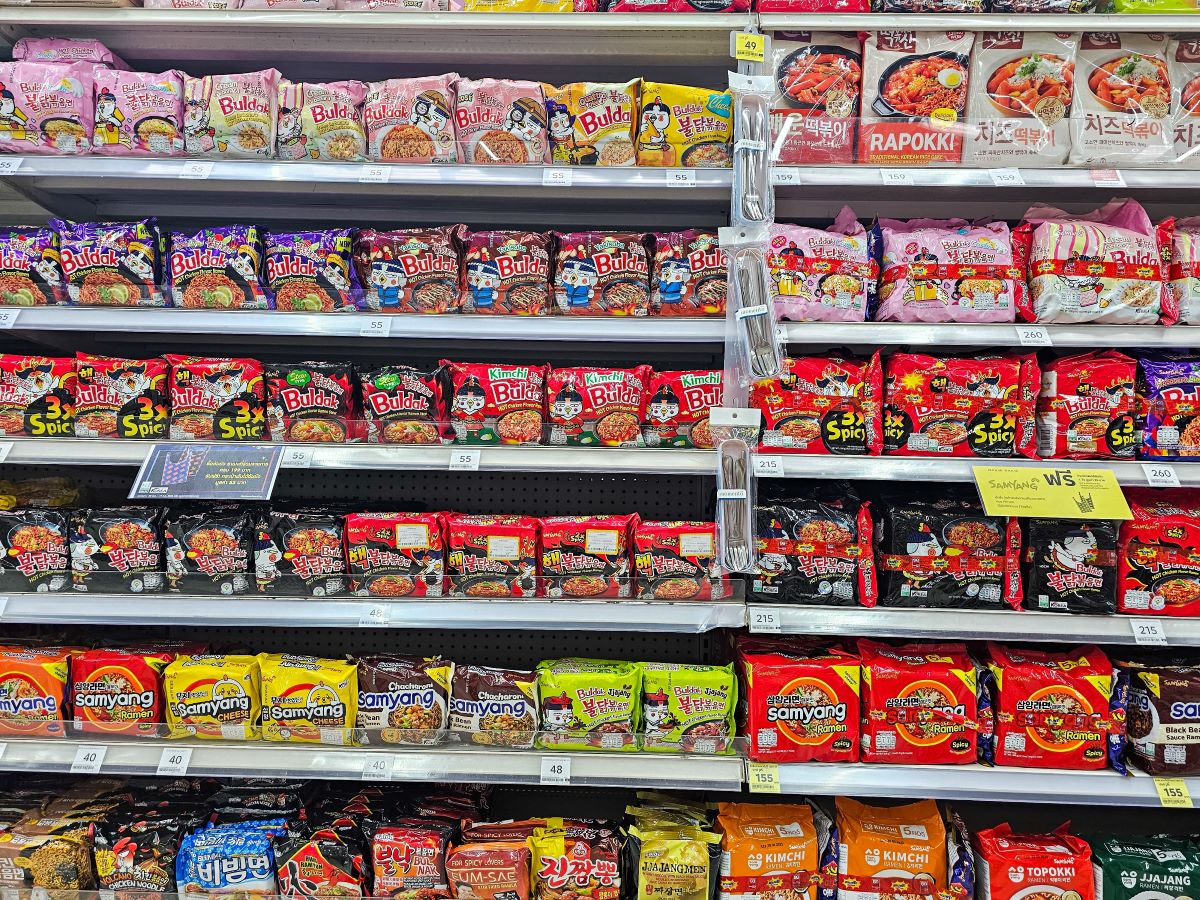

Samyang Foods is one of the earliest manufacturers of instant noodles in South Korea. The company’s offerings include Samyang instant noodles, Samyang bowl and cup noodles, as well as snacks such as corn snacks, and topokki (rice cake) snacks.

The company plans to focus on its global business and has established a dedicated team for global sales and logistics. Samyang Foods Vice Chairman Jung-soo Kim said, “We would like to carry out a major reshuffle to expand our overseas business based on our ‘Go-to-Market’ plan.”

Last year, the company achieved a year-on-year increase of 41.6% in its revenue earnings, reaching KRW 909 bn ($680 mn). During that same period, its operating profit came in at KRW 90.4 bn ($68 mn).

Samyang Foods’ shares are traded on the Korea Stock Exchange (KS: 003230). The company currently holds a market capitalisation of KRW 1.378 bn ($1 bn). The company’s stock has experienced an increase of 75.89%. Additionally, its shares are characterised by a PE ratio of 11.9, and a price-to-book ratio of 1.64.

Editor’s note: All stock movement figures as of September 13, 2023.

Australia

Australia China

China India

India Indonesia

Indonesia Japan

Japan Malaysia

Malaysia Philippines

Philippines Singapore

Singapore South Korea

South Korea Taiwan

Taiwan Thailand

Thailand Vietnam

Vietnam