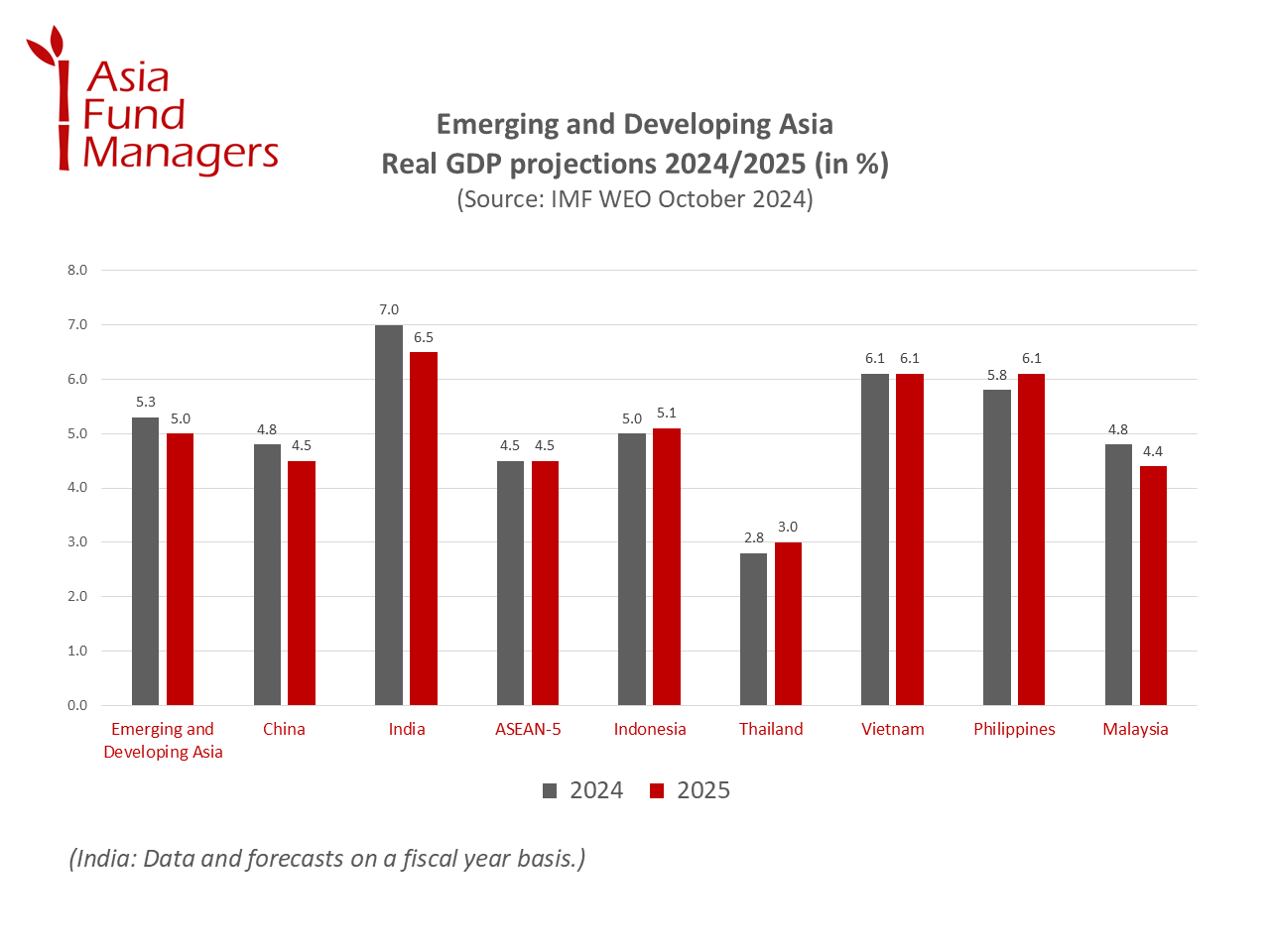

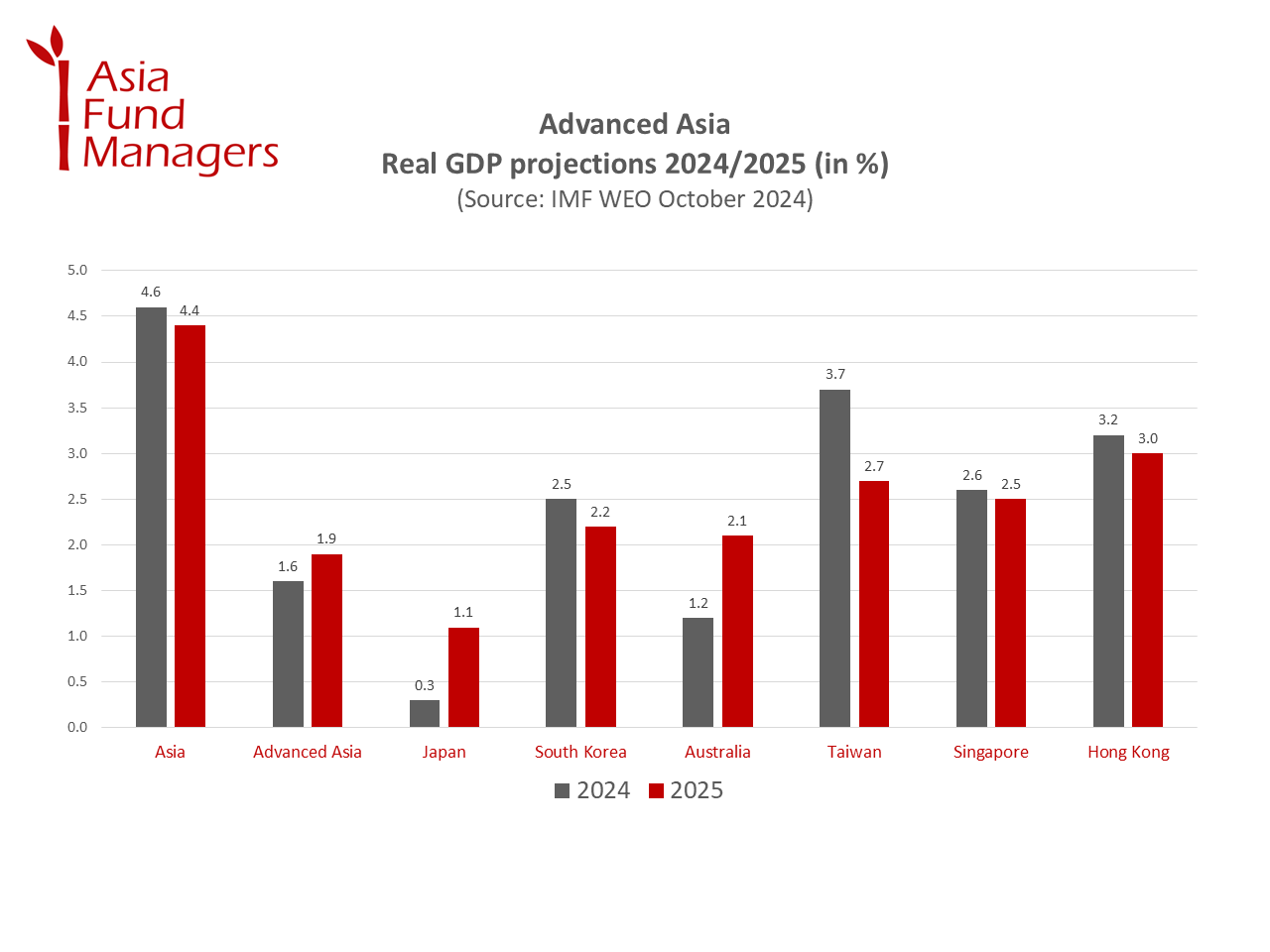

Despite a slowdown in China, growth in Asia continues with strong momentum, especially in emerging Asia, according to the latest World Economic Outlook (WEO) by the International Monetary Fund (IMF). Emerging Asia is gaining momentum due to the surging demand for semiconductors and electronics, which is driven by significant investments in artificial intelligence, the global lender explained. Looking at the Asia economy outlook, emerging Asia is projected to grow 5.3% in 2024 and 5.0% in 2025, while advanced Asia is expected to grow 1.6% and 1.9%, respectively.

“Performance in emerging Asia remains robust, despite the slight downward revision for China to 4.8% in 2024,” said Pierre-Olivier Gourinchas, Chief Economist at the IMF.

With 4.6% GDP growth in the third quarter, China just posted its weakest quarterly growth in over a year. The IMF warns that the weak performance could have far-reaching implications: “Deeper- or longer-than-expected contraction in China’s property sector, especially if it leads to financial instability, could weaken consumer sentiment and generate negative global spillovers given China’s large footprint in global trade.”

India remains the fastest-growing economy in the world. The IMF left its predictions for the fiscal years 2024-25 and 2025-26 unchanged at 7% and 6.5%, respectively. This is a slight moderation from the 8.2% growth in 2023.

Japan’s economic outlook was revised downward to 0.3% this year – down from the previous IMF forecast of 0.9% in April and 0.7% in July. The global lender cited disruptions in the automotive supply chain and a cooling tourism boom as reasons for the downward revision.

The ASEAN-5 countries – Indonesia, Malaysia, the Philippines, Singapore, and Thailand – are predicted to see a growth rate of 4.5% this year and 4.5% next year.

Global economy “stable yet underwhelming”

As for the global economy, the IMF left its prediction unchanged at 3.2% in 2024 and 2025. “Global growth is expected to remain stable yet underwhelming,” the report commented.

“Five years from now, global growth should reach 3.1%, a mediocre performance compared with the pre-pandemic average”, the IMF added.

Inflation is expected to fall further from the annual average of 6.7% in 2023 to 5.8% in 2024 and 4.3% in 2025. Advanced economies will return to their inflation targets sooner than emerging market and developing economies, according to the IMF forecast. However, there are still “bumps on the road to price stability,” the global lender warned.

„Risks to the global outlook are tilted to the downside amid elevated policy uncertainty. Sudden eruptions in financial market volatility—as experienced in early August—could tighten financial conditions and weigh on investment and growth, especially in developing economies in which large near-term external financing needs may trigger capital outflows and debt distress,” said the IMF report.

Australia

Australia China

China India

India Indonesia

Indonesia Japan

Japan Malaysia

Malaysia Philippines

Philippines Singapore

Singapore South Korea

South Korea Taiwan

Taiwan Thailand

Thailand Vietnam

Vietnam