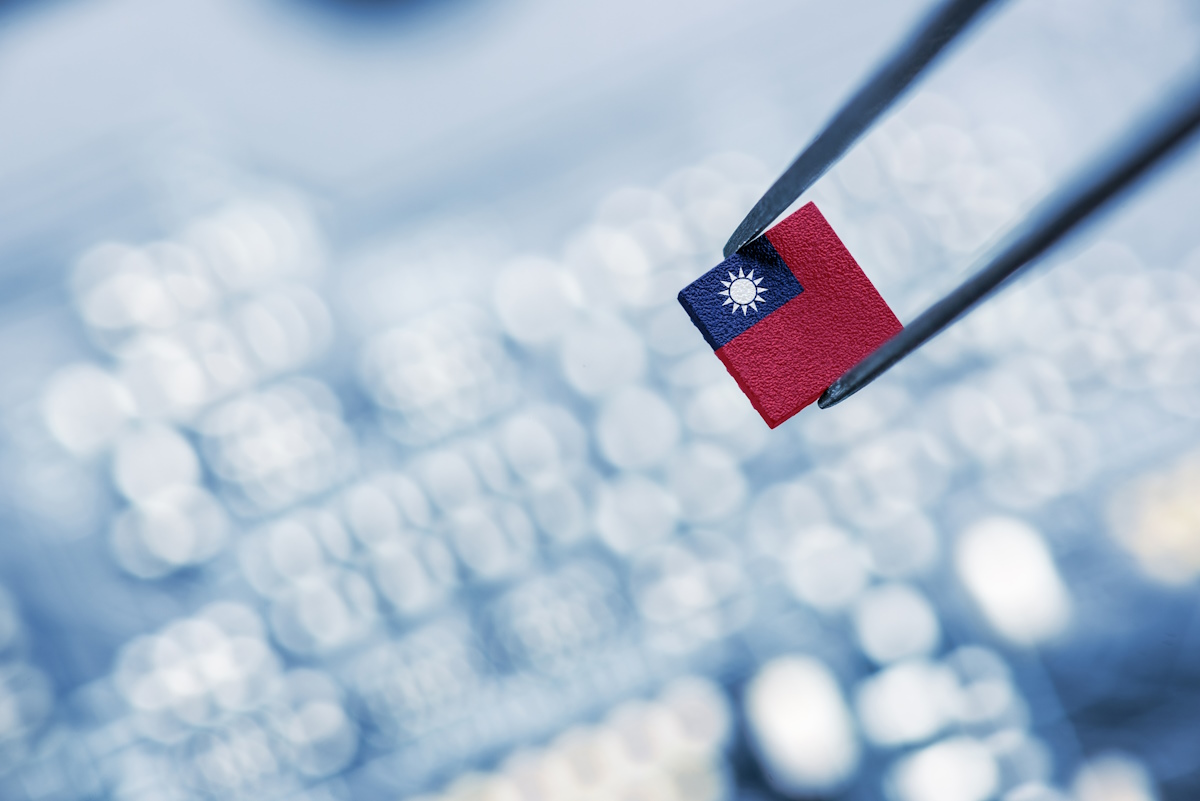

Taiwan was shaken by its strongest earthquake in 25 years. The 7.4-magnitude earthquake temporarily disrupted the production of semiconductor manufacturers on the island and once again emphasises Taiwan’s crucial role in the global technology industry.

Chip giant Taiwan Semiconductor Manufacturing Company (TSMC) temporarily stopped production and evacuated employees. Taipei’s DigiTimes reports that TSMC’s headquarters in Hsinchu, northwest of the island, is among those affected. According to an anonymous source, at least two production sites suffered damage, so all machines were stopped. There has not yet been an official statement on the extent of the damage.

Taiwan plays a crucial role in the global IT sector. It accounts for around two-thirds of the sector’s market cap in emerging markets (EM) and produces about 80% to 90% of the highest-end chips.

Several factors make Taiwan prone to disruption. The island is located at the junction of two tectonic plates; hence it is earthquake-prone. Furthermore, it is a geopolitical hotspot. The Chinese Communist Party views it as a breakaway province and aims to reintegrate it with mainland China eventually.

“With regard to geopolitical risk, many Taiwanese corporations have been under pressure to diversify their manufacturing and, as a result, they have invested in capacity in Southeast Asia and the US. Productivity and cost structures in these regions tend to be less

competitive than in Taiwan and China,” says Guido Giammattei, EM Equity Portfolio Manager at RBC BlueBay Asset Management.

TSMC, for example, opened its first plant in Japan earlier this year. The company is building a second factory in Arizona (USA) and planning its first plant in Europe, which will be built in Germany.

Australia

Australia China

China India

India Indonesia

Indonesia Japan

Japan Malaysia

Malaysia Philippines

Philippines Singapore

Singapore South Korea

South Korea Taiwan

Taiwan Thailand

Thailand Vietnam

Vietnam