Emerging markets have developed very differently over the past decades. The coronavirus pandemic, with its well-known consequences such as disrupted supply chains and declines in key industries, has affected each of them to varying degrees, but for most, 2022 has been difficult so far. Similarly, South Korea has struggled as well – but could be a candidate for a turnaround, writes Marcus Weyerer, Senior ETF Investment Strategist at Franklin Templeton, in this guest commentary.

In July 2021, South Korea was upgraded from an emerging market to an industrialized country by the UN Conference on Trade and Development (UNCTAD). Remarkably, this makes South Korea the first member to achieve this upgrade since the forum was founded in 1964. And yet South Korea is still listed as an emerging market in the investment sector, for example in the MSCI All Country World Index (MSCI ACWI). This is because despite all the demonstrable progress, such as the high GDP growth rates, there are still considerable uncertainties surrounding the future development of these young economies.

Therefore, investors should also keep an eye on these problems in South Korea:

- Korean equities have been on a downward trend since the record year of 2020

- The FTSE Korea 30/18 Capped Index is trading 35% (Bloomberg, June 2022) below its 2021 peak and just marked a new low in June 2022

- Given the war in Ukraine and its severe consequences for economies and financial markets, the situation remains difficult

- However, the fundamentals and outlook remain positive, also thanks to the new government, which is in line with other selected emerging markets

- Investors’ concerns are being expressed in favorable valuations

Difficult environment with glimmers of hope

After an extremely close presidential election, the market is once again focusing on fundamentals and hoping for positive stimulus from the new government. At 4% in 2021, Korean GDP growth reached an 11-year high. However, expectations for 2022 are muted as export growth slows and higher interest rates may weigh on domestic consumption. For example, the new central bank governor, Rhee Chang-yong, made it clear that he will push for higher interest rates to help keep inflation in check. As per Bloomberg, consensus estimates are around 3%. Consumer confidence has been rising this year and was at a high level of around 105 (+1.0) in May – well above the 100 threshold that separates positive from negative sentiment.

The Korean won is lower against the USD than it has been for a long time – around the level of 2009. With the Fed’s recent aggressive interest rate hike, the pressure on the currency could continue. An important goal of the government and central bank BOK – Rhee has announced closer cooperation with the government – is to support the export sector, which is essential for Korea and is strongly supported by the technology sector.

It is characterized by many market-leading companies, for example in the semiconductor sector, which are able to defend their margins thanks to strong pricing power. Samsung, for example, is currently negotiating a 15-20% price increase for semiconductor products with its customers. According to the Bank of Korea, consumer price index growth rose from 4.1% to around 4.8% from April to May 2022. The government announced a cut in the petroleum tax from 30% to 20% and temporary subsidies to cushion the price increase.

Even before the elections, the Korean National Assembly approved a $14 billion supplementary budget, part of which is dedicated to supporting companies affected by a renewed flare-up of Covid-19.

South Korea: a solid baseline

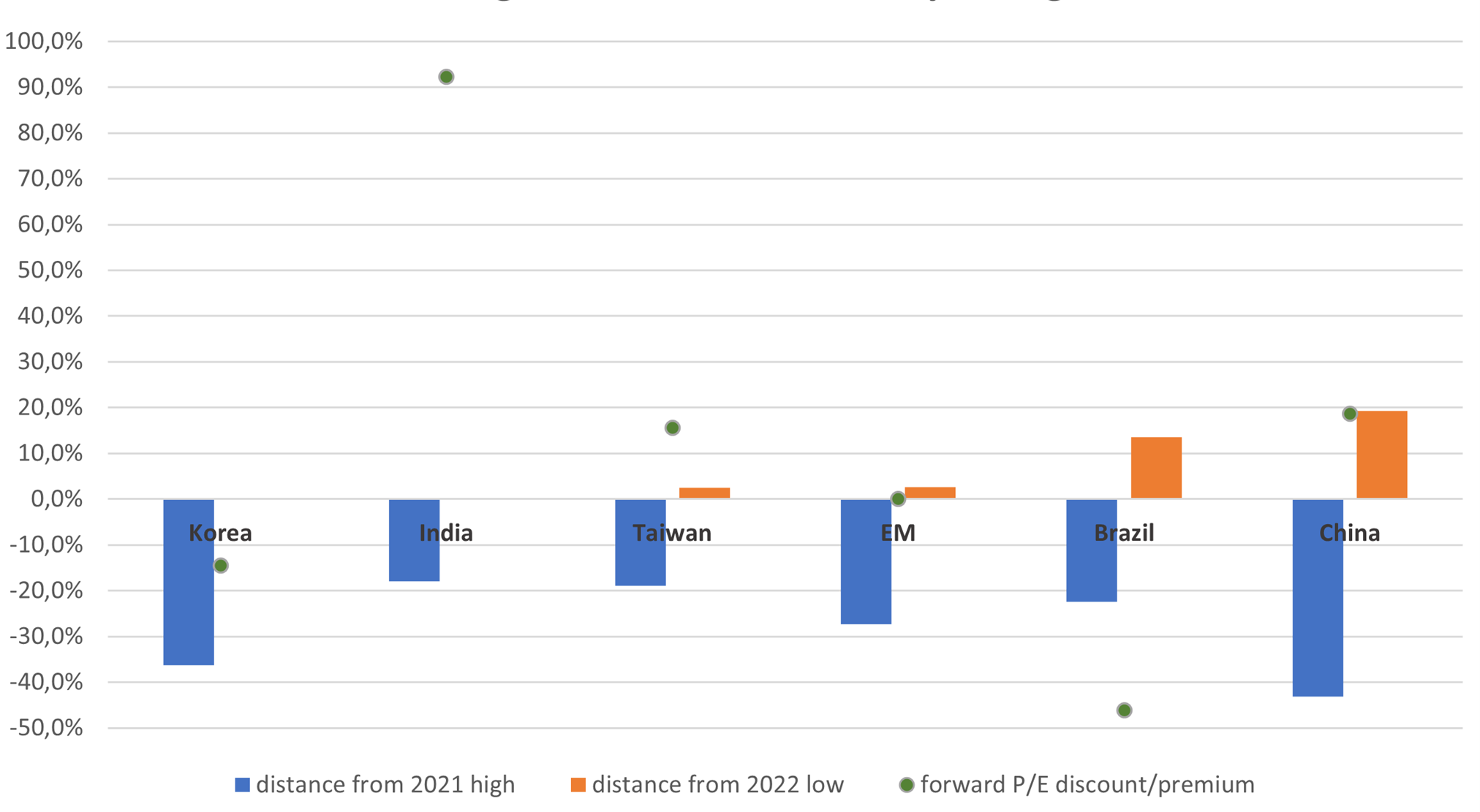

The markets have hardly reacted positively to these measures. In fact, Korean stocks are currently trading at their 2022 lows. By comparison, China has already gained almost 20% from its low, while Brazil has still managed to climb 14%. Korea also appears cheaply valued with a P/E ratio of 8.3 estimated by Bloomberg – lower than broad emerging markets and at a 50% discount compared to developed markets.

The debt-to-GDP ratio continues to rise, but remains very moderate at around 0.5. Foreign exchange reserves were around $450 billion in May, close to an all-time high. The new government will seek to reduce budget deficits, which could curb inflation but comes with risks to growth. On the other hand, the government under the new President Yoon Suk-Yeol has pledged to scale back regulation and push ahead with promoting research and development, supporting childcare and housing (both public and private) – all of which should have a positive impact on growth in the medium term.

Australia

Australia China

China India

India Indonesia

Indonesia Japan

Japan Malaysia

Malaysia Philippines

Philippines Singapore

Singapore South Korea

South Korea Taiwan

Taiwan Thailand

Thailand Vietnam

Vietnam