Once a world leader in chip manufacturing, Japan semiconductor industry has stalled due to fewer investments in the sector. The Japanese government is now trying to revive the semiconductor industry and will be providing 70 bn yen (~$500m) in subsidies to a newly formed company called Rapidus, launched by a consortium of eight major tech firms and automakers in the country.

The consortium — Toyota, Sony, NTT, Softbank, Kioxia, Denso, NEC and MUFG Bank – have pooled in resources to set up Rapidus, with a total paid-up capital of 7.3 bn yen (~$51.5 m). The company was launched by Japan’s Minister for Economy, Trade and Industry Yasutoshi Nishimura on November 11. The board of the new chip-making firm will be chaired by Tetsuro Higashi, the former CEO of Tokyo Electron.

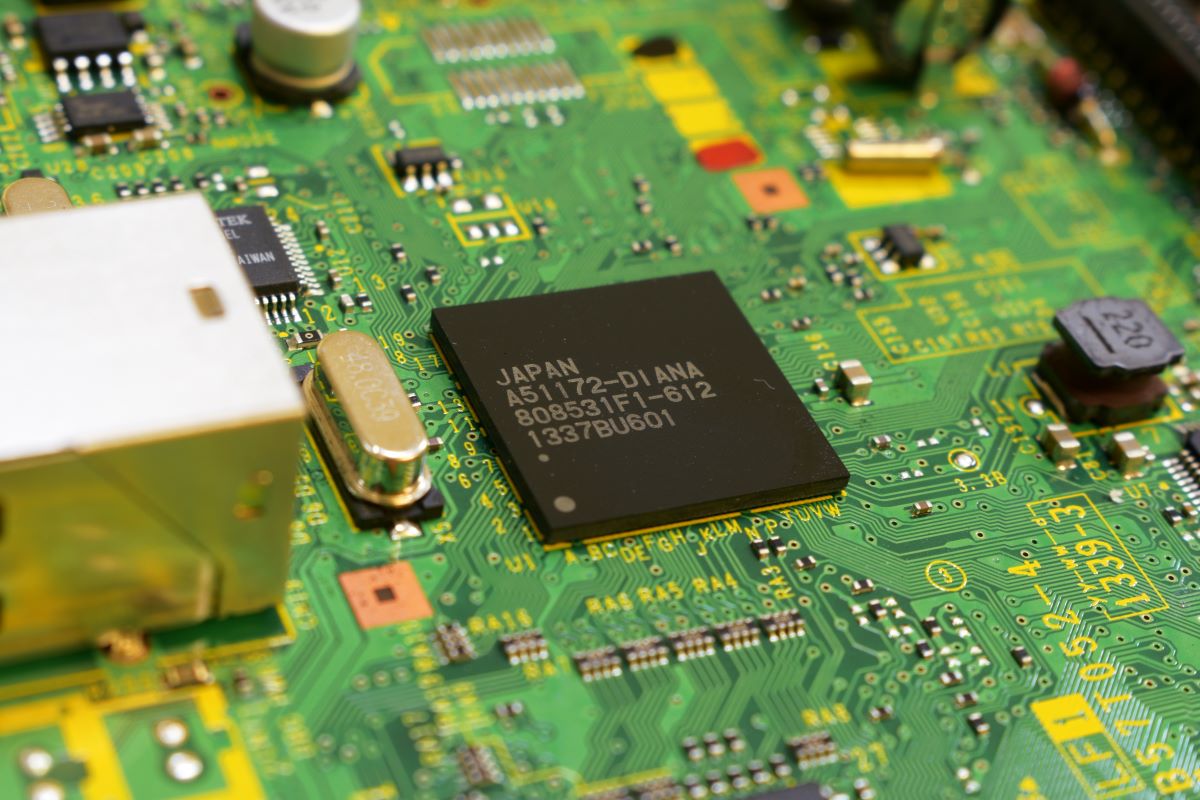

A new dawn for Japan semiconductor industry?

Each member of the consortium is contributing 1 bn yen (~$7 m) in Rapidus, while MUFG Bank is injecting 300 m yen.

“Semiconductors are going to be a critical component for developing new leading-edge technologies such as AI, digital industries and health-tech,” Nishimura told media persons. “Semiconductors are becoming even more important from an economic security perspective.”

The domestic production of chips in Japan is vital as the primary supplier Taiwan is susceptible to geopolitical risks due to China’s aggressive stance. Rapidus President Atsuyoshi Koike, who previously headed Western Digital, said that this will be the ‘last chance’ for Japan to make a comeback.

The new chip firm has plans to spend 5 tn yen (~$36 bn) in capital expenditure and investments over the next decade. Rapidus aims to develop next-gen semiconductors of 2 nm and beyond and plans to start mass-producing chips by 2027. By 2030, Rapidus will start contract manufacturing for other companies that design chips.

The chip war between US and China presents an opportunity as well as a risk for Japan. While it can capitalize on the dearth of chips on the market, Japan wants a secure supply of semiconductors for its carmakers and IT companies for future innovations.

Japan’s diversification in chips

The Japanese government is doling out subsidies to chipmakers and ramping up efforts to increase manufacturing. Earlier this year, Japan offered Kioxia Corp and Western Digital 93 bn yen in subsidies to expand output in Japan. Later in September, Japan said it will give US chipmaker Micron Technology 46.5 bn yen to increase capacity at its manufacturing facility in Hiroshima.

Siding with the US has become a priority for Japan. Rapidus was established just weeks after the Japanese government said it is investing 350 bn yen (~$2.5 bn) to create a joint research and development hub with US and European firms. The joint effort is called the Leading-edge Semiconductor Technology Center (LSTC) in which Rapidus is participating. LSTC will be established formally by the end of 2022 and will work towards developing technology to make 2 nm chips by the second half of the decade.

Through LSTC, Rapidus will work alongside IBM and other US technology firms on the development of 2-nm chips.

“By cooperating with overseas research institutes and industries, especially those of the United States, we would like to strengthen the basis of Japan’s semiconductor industry and its competitiveness through joint efforts by academia and industry,” Nishimura said.

Australia

Australia China

China India

India Indonesia

Indonesia Japan

Japan Malaysia

Malaysia Philippines

Philippines Singapore

Singapore South Korea

South Korea Taiwan

Taiwan Thailand

Thailand Vietnam

Vietnam