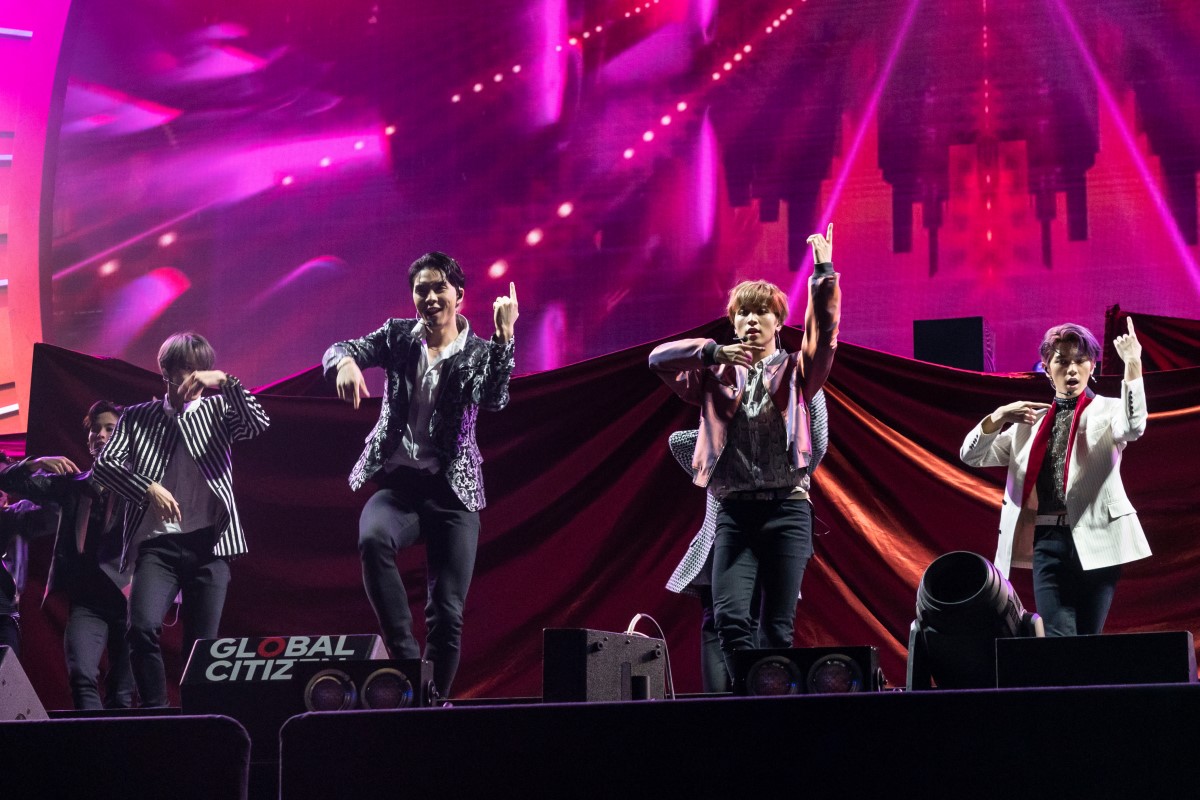

Among Asia’s most developed economies, South Korea is advancing in the global entertainment industry with its wide range of movies, TV shows and K-pop. The thriving music industry has given rise to the trend of investing in K-pop and new financial assets are slowly emerging to capitalize on this boom.

The Korean wave (Hallyu) has encompassed nearly all the youngsters around the world and contributed an estimated $12.3 bn in 2019 to South Korea’s economy. It is estimated that the K-pop industry generates about $10 bn every year by now, with the number likely to rise in line with the popularity of the music genre in foreign nations.

Options for investing in K-pop

Bands like BTS (currently on a break) have achieved tremendous success and have become a global phenomenon, generating income for South Korea in the form of tourism and merchandise manufacturing. With the Hallyu wave expected to continue contributing to the Korean economy, asset managers have started exploring investments in media and entertainment companies.

“The companies are continuing to expand their global fan bases, which should lead to higher album sales and larger concerts for established artists, as well as a rapidly rising profit contribution from newer artists amid an overall increase in album sales,” Mirae Asset Securities said in a note.

Seoul-based CT Investments, a unit of music IP investment firm Contents Technologies, on September 1 launched the KPOP and Korean Entertainment ETF on the NYSE Arca exchange. This gives overseas investors exposure to the growth potential of the K-pop industry and the broader Korean entertainment sector.

“The global market for K-pop is still at an early stage of growth and the KPOP and Korean Entertainment ETF will offer thematic exposure to key companies in the Korean entertainment and media industry that stand to benefit from this secular trend,” said Jangwon Lee, CEO of CT Investments and Contents Technologies.

The fund, under the ticker KPOP, will track the KPOP Index which includes 30 entertainment and interactive media companies that are listed on the Korean Exchange. Some of these names include entertainment companies such as HYBE, the agency that manages BTS, JYP Entertainment Corp, SM Entertainment Co and YG Entertainment Inc. These four companies are the same names that Mirae Asset is bullish on, as per its note.

The KPOP and Korean Entertainment ETF target a 70% to 80% weightage in the entertainment industry and the rest in the interactive media and services space, with a quarterly rebalance.

Separately, South Korea-based VIP Research & Management predicted the rise of K-pop and K-drama and has been investing in K-pop companies even before Netflix’s “Squid Game” attained global popularity. One of VIP’s funds called the ‘Buy Cheap Korea’ had gained 91.9% over the past two years, much higher than the benchmark Kospi which rose 6.3%.

Australia

Australia China

China India

India Indonesia

Indonesia Japan

Japan Malaysia

Malaysia Philippines

Philippines Singapore

Singapore South Korea

South Korea Taiwan

Taiwan Thailand

Thailand Vietnam

Vietnam