South Korea, Asia’s fourth-largest economy and 12th-largest in the world, has grown into a high-tech economy. The country is the world’s leading producer of displays and memory semiconductors and the second-largest manufacturer of ships. Hence, when it comes to South Korean export strengths, the focus tends to fall on the biggest sector, technology. However, in recent years, the country has also made headlines worldwide with another export hit: its musical culture, K-pop, which has a huge economic impact on the country.

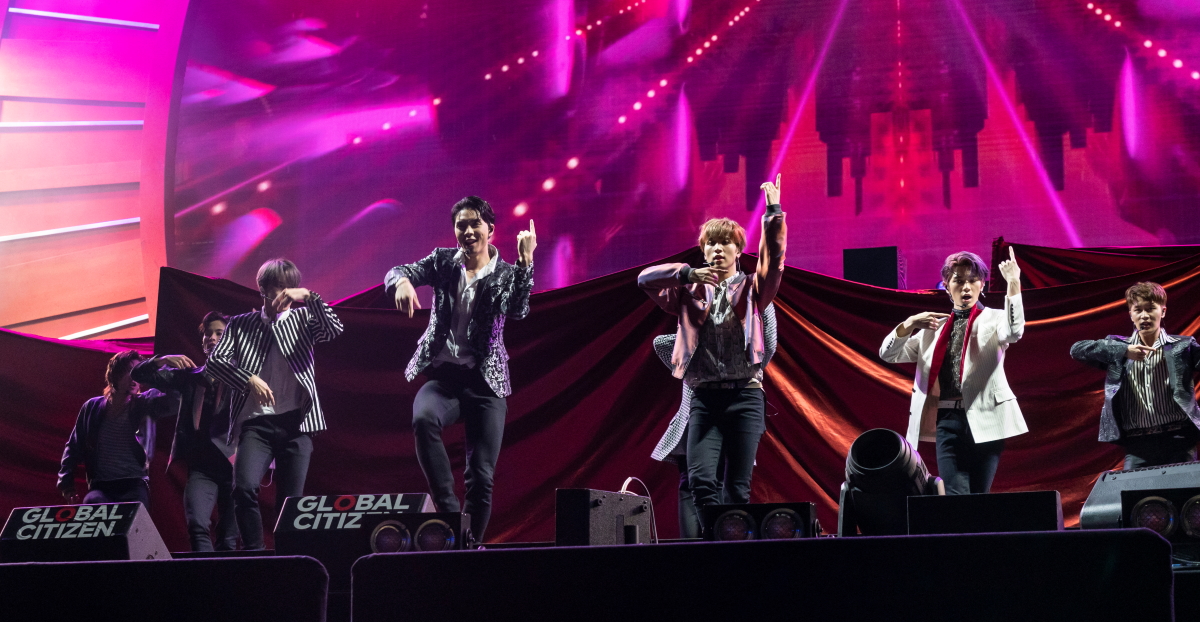

South Korea’s K-pop culture and music industry have become increasingly popular, allowing the propagation of the music genre to many foreign nations through the Korean wave, also known as Hallyu.

According to a survey by the Korea Foundation and Ministry of Foreign Affairs, the number of Hallyu fans worldwide totalled 225 million last year – up from 9.26 million in the first survey in 2012. There are 1,748 Hallyu fan clubs across 119 countries. As per the report, about 68% of fan clubs focus on K-pop.

K-pop and the economic impact on South Korea

“A wave of global interest in all things South Korean, from TV shows and movies to food, has helped K-pop amass a large following in the West,” says Morgan Stanley Research equity analyst Seyon Park. “Now, many of the newest performers are incorporating Western pop elements, including input from Western songwriters, to broaden their listener base.”

A report by Allied Market Research showed that the K-pop events market alone was valued at $8.1 bn in 2021 and is estimated to reach $20 bn by 2031, growing with a CAGR of 7.3% from 2022 to 2031.

Overall, the South Korean music industry (including K-pop) reached a record-breaking sales revenue of approximately 11 tn KRW in 2022, along with an export value of around 927.6 mn USD, according to Statista.

South Korea’s four largest music agencies tripled their combined revenue to nearly $3 bn between 2019 and 2023, and their operating profit reached $450 mn.

“Currently, K-pop only accounts for an estimated 3% of the U.S. recorded music industry, pulling in less than half the revenue of Latin and country genres,” says Park. “We see a long runway for K-pop to grow and expand its share in this market and, more broadly, in the $130 billion global music industry.”

Broader economic impact of K-pop’s popularity

Overall, the rise of K-pop has significant economic implications, not only boosting the music industry but also related sectors globally.

“We believe that Korea’s cultural influence should not be underestimated in terms of importance. According to US News, Korea’s global cultural influence ranking jumped from 31st in 2017 to 7th in 2022, driving tourism, as well as industries such as cosmetics,” says US asset manager Dalton Investments.

Media and broadcasting have expanded beyond domestic markets, with Korean shows reaching international audiences, increasing advertising revenue and sponsorships.

„New streaming options and social media have helped the popularity of K-dramas and shows such as Squid Game. In 2023, Netflix pledged to spend $2.5 bn over the next four years in the country as K-drama mania has grown and helped fuel a surge in global subscriptions,” says Dina Ting, Head of Global Index Portfolio Management at Franklin Templeton ETFs.

“About three-fifths of Netflix’s users have watched a South Korean show, and viewing time for those programs has grown six-fold in just four years, according to Netflix,” she adds.

Furthermore, the fashion and beauty industries in South Korea benefit from the influence of K-pop idols, leading to collaborations and increased demand for Korean-inspired fashion. The collaboration between K-pop artists and major global brands shows the growing cross-marketing influence of K-pop.

New Jeans, a girl band that debuted in 2022, is an ambassador for global brands such as Levi’s, Coca-Cola, and Calvin Klein. Members of Blackpink, another K-pop girl band that debuted in 2016, collaborate with luxury brands Chanel, Cartier, Dior, and others.

Investing in K-pop

While K-pop’s rise seems unstoppable, analysts warn that the Korean entertainment industry faces risks that could impact its growth. Renegotiating contracts with key performers, controversies surrounding stars’ personal lives, and declining album sales in China are key issues to watch, notes Morgan Stanley’s Park.

To sustain growth, the industry must leverage new talent, increase streaming revenues, and hold more concerts with existing artists, Park opines.

“Companies that can continually evolve their business models to make deeper inroads in new markets and broaden the audience base will prove most successful,” he adds.

Australia

Australia China

China India

India Indonesia

Indonesia Japan

Japan Malaysia

Malaysia Philippines

Philippines Singapore

Singapore South Korea

South Korea Taiwan

Taiwan Thailand

Thailand Vietnam

Vietnam