As the tech war between the US and China heats up, Japan is the latest to join in. Effective from July 23, 2023, Japan added 23 chip-manufacturing items that require approval for export, under the foreign exchange law. Though the country has not specified China in the list of export-restricted countries, Beijing has expressed its displeasure over Japan’s chip export curb. On the other hand, these items would be smoothly exported to the US, South Korea, and Taiwan.

In October, the US launched stringent rules to cut off exports of key chips and semiconductor tools to China. The move was meant to stop China from strengthening its domestic technology industries. In retaliation, China has restricted the exports of two key metals for semiconductor manufacturing to the US and Europe.

Japan and the US are concerned about China’s “technology supremacy”, therefore in May, it agreed with other Group of Seven industrial nations on “de-risking” from potential Chinese economic pressure.

Impact of Japan’s chip export curbs on China

China was eying “semiconductor autonomy”, but with export curbs from the US, the Netherlands, and now Japan, this seems a distant possibility. It will now have limited access to equipment or technology to build advanced semiconductors. Japan plays a key role in the semiconductor supply chain.

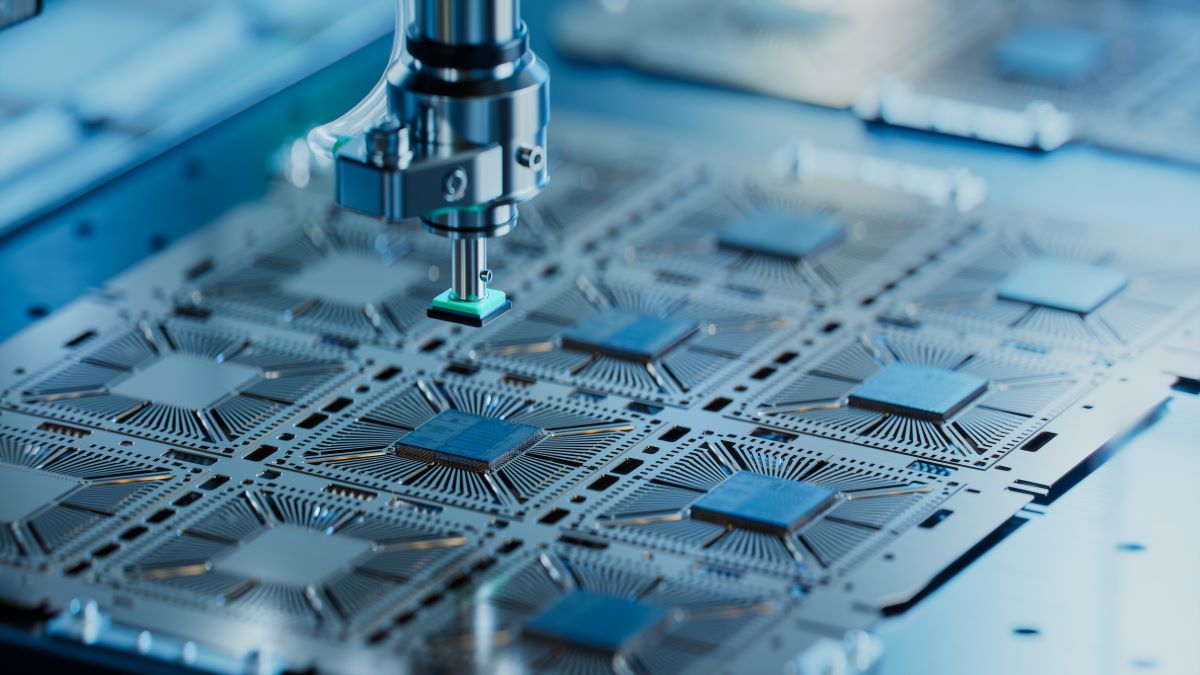

These restricted export items include wafer-cleaning equipment, checkups, and lithography machines. These are the components crucial in producing cutting-edge chips. Some of the Japanese companies are key suppliers of photoresist coaters and developers as well as mask inspection equipment needed to make the most advanced chips. Akira Minamikawa, analyst at research company Omdia cautioned, “Japan joining the export curbs will do great harm to China’s ability to make and develop chips smaller than 16 nanometers.” Eventually, China could start developing its own technology, but given the pace of advancements, this could take a considerable amount of time.

Will Japanese semiconductor companies face the brunt?

Japan has a $30 bn semiconductor equipment-making industry, and top companies in this supply chain like Lasertec and Tokyo Electron generate a great portion of their revenue from China. However, most of these companies expected a limited impact of these export curbs on their business. The exports would continue steadily for South Korea, Taiwan, and Singapore. Even Japanese industry minister Yasutoshi Nishimura stated that the impact on domestic companies would be limited as the export controls were aimed at “extremely advanced” technology.

However, experts feel that Japan’s chip export curbs may not be in its best interests in the long run. They feel these restrictions could create uncertainties for chipmaking companies and force them to recalibrate their long-term marketing strategies. Also, China is a long-term trading partner of Japan, and these export curbs could impact the global semiconductor industry and Japan’s competitive edge in the market. The Chinese Academy of International Trade and Economic Cooperation stated that in 2022 equipment exports from Japan to China were worth 820 bn yen ($5.85 bn), accounting for over 30% of Japan’s total chipmaking equipment exports. This is also double the size of US exports to China. In a nutshell, if Japan loses China as a market, its economy could suffer.

Meanwhile, Deloitte in its report on the Japanese economy for July 2023 has already highlighted a weak picture of the nation’s semiconductor industry. According to Deloitte, Japanese semiconductor exports dropped 12.1% from a year earlier, while semiconductor machinery exports declined 20.2%.

Will Japan lift the curbs in the future?

While Japan has not specifically mentioned China as a subject of its export curbs, it is concerned about major backlash from its neighbour. It fears that China, a major market for its automobiles, would ban its electric vehicles. It will be interesting to watch if Japan sticks to its promise to the US or revisits these export curbs on China to safeguard its position in the semiconductor supply chain.

Australia

Australia China

China India

India Indonesia

Indonesia Japan

Japan Malaysia

Malaysia Philippines

Philippines Singapore

Singapore South Korea

South Korea Taiwan

Taiwan Thailand

Thailand Vietnam

Vietnam Germany

Germany Hong Kong

Hong Kong USA

USA Switzerland

Switzerland Singapore

Singapore

United Kingdom

United Kingdom