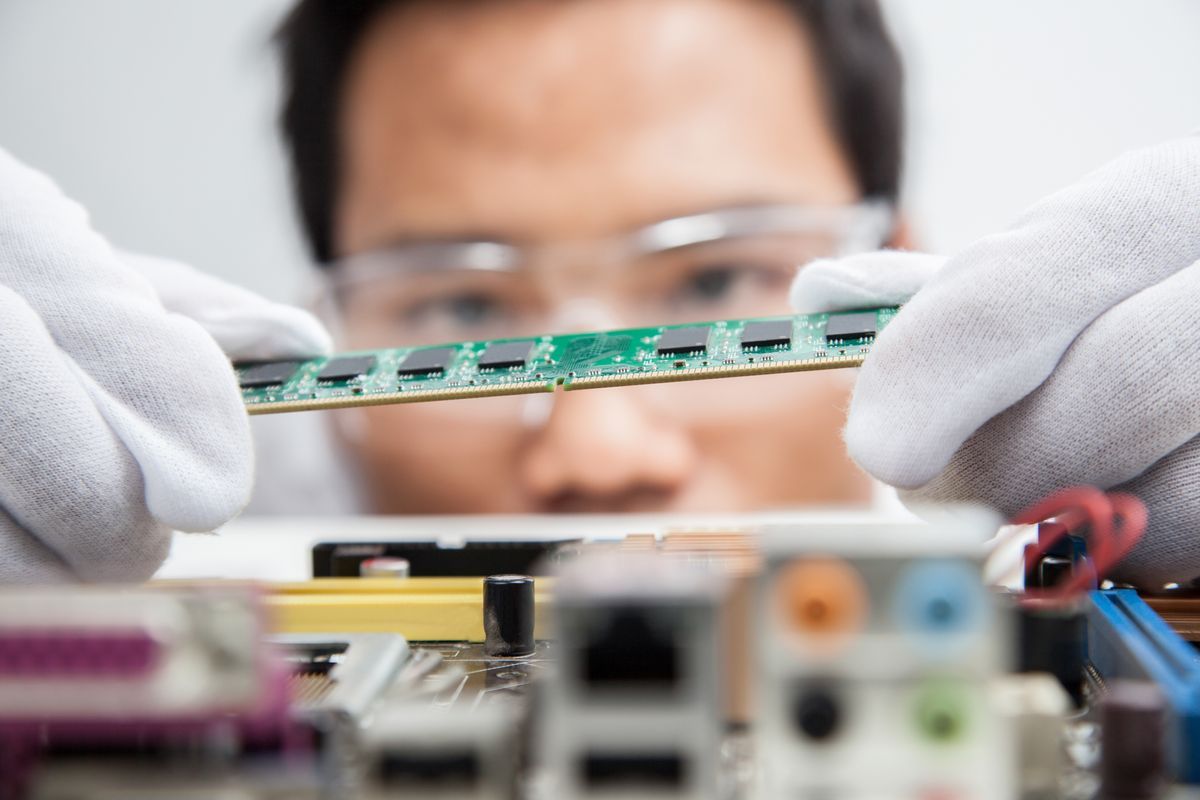

The Biden government on Friday enforced sweeping rules on technology exports to China, barring US firms from selling certain semiconductors for supercomputing and artificial intelligence, targeting the China chip industry. The US has been trying to block high-end chip innovation in China and restrict access to US-made technology, which nearly all companies in the semiconductor supply chain already use.

Under the new rules, the US Commerce Department has barred American firms from exporting certain advanced chip equipment to a customer in China without a license. Another clause includes amendments to the Foreign Direct Product Rule, under which the US aims to block China’s chip industry from accessing any cutting-edge technology for supercomputers and artificial intelligence.

The new rules are the harshest till now after Huawei’s ban, with global chipmakers such as Samsung and TSMC, also barred from selling chips to China as they use American technology.

Fallout in the China chip sector

Paul Triolo, a China and technology expert at the Albright Stonebridge consultancy, tells Financial Times that the impact will be severe on Chinese companies using US-made hardware to deploy AI algorithms for autonomous vehicles, medical imaging and AI-modelled drug discovery.

“The PRC government is attempting to divert a lot of civilian technologies, particularly in computing, space, AI and communications, into areas of supercomputers in civil-military fusion programs as well as other areas such as surveillance that link with human rights abuses,” a US Commerce Department official said during a press briefing.

The new measures make it harder for Chinese firms to access advanced chips and the tools to make them, which the US believes are being used for military modernization by Beijing. To enforce these curbs, over 30 Chinese companies have been added to the ‘Unverified List’, which acts as a red flag for US suppliers as they cannot be inspected by US authorities. Additionally, these companies are at risk of being added to the ‘Entity List’ alongside Huawei and 28 other firms which are completely blacklisted from accessing US technology.

Going forward, companies looking to source chip equipment for making processors and other logic chips using the 14/16-nanometer technology or better will need to apply for a license. The problem is, China relies heavily on this type of technology as it is a laggard in chip development.

Under memory chips, the US restrictions are for tools that are 18-nanometer or better, while rules for NAND flash memory restrict the supply of machinery capable of making chips with 128 or more layers.

“The US provides more than 80% of the world’s chip design equipment, 50% of the core intellectual property (IP core) and about half of the global chip manufacturing equipment,” says Yan Taw (YT) Boon, Head of Thematic – Asia, at Neuberger Berman. “Despite a seemingly small market size of $95 bn, it is undeniable that manufacturing equipment is the pillar of the $600 bn semiconductor industry and larger $2.5 tn electronics market.”

The bigger issue for Chinese chipmakers is the barring of ‘US persons’ from providing support to China chip development and production “without a license”. FT reports that most US citizens working in the Chinese chip sector are Chinese or Taiwanese returnees from the US, and most of them are unwilling to give up their US passports. This means that China chip businesses will have to hire new executives.

Impact on China chip firms

On Friday, the US added China’s top memory chipmaker YMTC and 30 other firms to its ‘Entity List’ as they cannot be inspected by US officials. There is a 60-day limit for a resolution post which these companies could face tougher penalties.

The Commerce Department is investigating YMTC for allegedly violating US export controls by selling chips to Huawei. This could also hit Apple, which is considering using chips from YMTC for some of its iPhones in China.

Earlier, the US had restricted semiconductor toolmakers KLA Corp, Lam Research Corp and Applied Materials Inc to halt shipments to Chinese-owned factories involved in the manufacturing of advanced logic chips.

The new set of rules left China’s tech stocks in a lurch, with major chipmaking companies diving when markets opened on Monday. China chip equipment maker Naura Technology Group was down 10%, Hwatsing Technology ended the session over 17% lower. Chip tool maker Advanced Micro-Fabrication Equipment shed nearly 20%.

Some other stocks that saw declines are chipmaking chemicals maker Anji Microelectronics, which was down 20%, and testing equipment provider Hangzhou Changchuan, which ended the day 20% lower. Among AI chip makers, Cambricon Technology was down 8% while memory chip provider GigaDevice fell 8.8%.

The new set of rules by the US evoked a strong response from China, with Global Times publishing an editorial that said, “The US hegemony in science and technology that harms others without benefiting itself may bring some short-term difficulties to China’s semiconductor industry, but will, in turn, strengthen China’s will and ability to stand on its own in science and technology.”

Australia

Australia China

China India

India Indonesia

Indonesia Japan

Japan Malaysia

Malaysia Philippines

Philippines Singapore

Singapore South Korea

South Korea Taiwan

Taiwan Thailand

Thailand Vietnam

Vietnam Germany

Germany Hong Kong

Hong Kong USA

USA Switzerland

Switzerland Singapore

Singapore

United Kingdom

United Kingdom