The issue of climate change has been gaining massive mileage over the past decade, and countries worldwide have set different timelines to go carbon neutral. India has been committed to the cause for multiple years and has made conscious efforts to switch from fossil fuels to more sustainable renewable energy sources like solar and wind.

With substantial government initiatives like Solar Park Scheme, Defence Scheme, Canal bank & Canal top Scheme, Bundling Scheme, Grid Connected Solar Rooftop Scheme, and advanced technology at play it is now much more cost-effective to harness solar power. The economies of scale have resulted in reduced solar cell/ module prices and solar tariffs in India have also achieved grid parity.

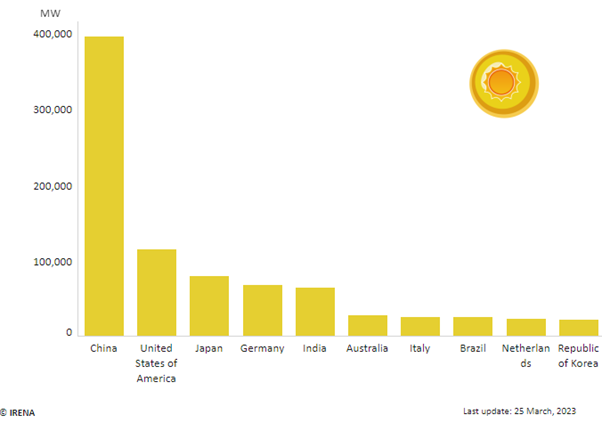

Today, Indian ranks 5th on the global list of solar power generation, ahead of Australia, Italy, and Brazil. Solar power installed capacity in India has reached around 61.97 GW as on 30th November, 2022, and it still has a pipeline of about 58 GW utility-scale projects. The government also achieved 100 GW of grid-connected solar power by 2022.

Reasons to invest in Indian solar stocks?

Investors can participate in India’s growing renewable energy sector through solar stocks Here is a quick look at some of the factors that create a favourable environment for investing in the solar energy segment.

Expanding market: As the Indian economy is rapidly expanding and turning into a global industrial powerhouse, the demand for energy needs to soar. Increased urbanisation, rising disposable incomes, and a growing population base will contribute to high aggregate demand. By 2040, India’s portion of the world’s total primary energy demand is estimated to quadruple to 11%. To meet this gigantic demand while remaining committed to lowering its carbon footprint by 35% from 2005 levels, India’s power generation needs to increase threefold by 2030.

Large unmet power demand: Currently, nearly 53% of the country’s energy requirements are met by coal-generated thermal power, but experts believe that it might not last beyond 2050. India also experiences a power shortage with a demand-supply gap of 12%. This wide gap can only be met with the use of renewable energy sources and solar energy has emerged as the most feasible option to plug this disparity.

Unprecedented Government Schemes: Launched in 2010, the Jawaharlal Nehru National Solar Mission (JNNSM) has a target of 40 GW Rooftop and 60 GW through Large and Medium Scale Grid Connected Solar Power Projects. In the past seven years, more than $70 bn investment has been made in renewable energy. The Indian Government has already set a target of 280GW solar panels by 2030 which implies an installation of 10GW each year. To let every Indian reap the benefits of solar power, in July 2022, the current government announced the National Subsidy Scheme for solar panel installation at home.

Diversification benefits: From a pure investment perspective, solar stocks can be a good diversification and de-risking strategy as there is a minimal link between solar stocks and other sectors like FMCG (Fast-Moving Consumer Goods), mining, metals, construction etc. Thus, solar energy stocks can be an effective hedge in volatile times. This is also because power-sector companies, especially solar have long-term contracts, that allow an earning visibility for decades or more in some cases.

Indian solar stocks to watch out for

Solar companies in India usually generate revenue by developing solar power projects, manufacturing solar panels, offering solar installation services, or operating solar power plants.

Here’s a list of some of the best solar energy stocks that an investor can consider investing in for the medium to long term. It’s noteworthy that not all these companies are into pure solar energy market. Some of the larger conglomerates have solar energy as a small part of their portfolio, but they have a promising presence.

Tata Power

Tata Power Solar Systems Ltd, a subsidiary of Tata Power, is a prominent player and offers a range of solar products and solutions, including solar modules, solar cells, and rooftop solar installations. Tata Power Solar has a portfolio of over 7GW of ground-mount utility-scale, over 750MW of rooftop and distributed generation projects across the country. It has installed over 55000 Solar Water Pumps in India till date.

Last year, the company also announced a massive investment of Rs 750 bn towards renewable energy. It also bagged an order of 300MW Solar project from NHPC. The project aims to reduce around 636,960 carbon emissions and is likely to generate approximately 750 million units annually. They plan to use cells and modules made in India for the project installation.

The company’s net sales rose by 31.7% year on year to Rs 551 bn ($66.8 mn) in the fiscal year ended March 2023. It’s operating profit dropped by 2.8% to Rs 42.6 bn ($0.56 mn).

Listed on the Bombay Stock Exchange as TPWR, Tata Power has a market capitalisation of Rs 719.32 bn ($87.2 mn). The company’s stock has risen by 3.6% in the past year. It has a PE ratio of 21.59 and a PB ratio of 2.50.

Adani Green Energy

Adani Green Energy develops both utility-scale and distributed solar power projects, including ground-mounted solar parks and rooftop solar installations. They also operate wind power projects across various states in India. This renewable energy company is developing a renewable portfolio of 25 GW by 2025 which includes wind power, solar power, and hybrid power projects.

The company’s net sales rose by 51 8% year on year to Rs 77.9 bn ($945.8 mn) in the fiscal year ended March 2023, while the operating profit rose by 59% to Rs 42.45 bn ($515.3 mn).

Listed on the Bombay Stock Exchange as ADANIGR, Adani Green Energy has a market capitalisation of Rs 1.5 trillion ($18.2 bn). The company’s stock has declined by 49.9% in the past year. It has a PE ratio of 177.02 and a PB ratio of 21.0.

Suzlon Energy

Suzlon Energy Ltd is another leading renewable energy company based in India, specialising in wind power generation and related services. The company stepped into the solar energy sector in 2016 and has successfully installed and commissioned portfolio of 340 MW across various states. Suzlon has also registered 1,500 MW wind-solar hybrid park in the state of Rajasthan. It is deeply involved in power generation, land procurement, liaison and working with various state utilities in India.

The company’s net sales dropped by 9% year on year to Rs 59.46 bn ($72.3 mn) in the fiscal year ended March 2023. Operating profit fell by 8% to Rs 5,7 bn ($69.1 mn).

Listed on the Bombay Stock Exchange as SUEL, Suzlon Energy has a market capitalisation of Rs 216 bn ($26.2 mn). The company’s stock has rallied by 168.4% in the past year. It has a PE ratio of 7.05 and a PB ratio of 19.0.

Websol Energy Systems Ltd

The small-cap company, Websol Energy System, manufactures photovoltaic monocrystalline solar cells and modules in India. The company is engaged in the production of solar photovoltaic cells and modules. The company has managed 94.43 GW worth of renewable energy projects. Its products are also used in domestic and international commercial and industrial settings. Websol has around 250 MW of fully automated module lines and about 250 MW of cells comprise its manufacturing capability.

The company’s net sales dropped by 91.9% year on year to Rs 172.2 mn ($2.08 mn) in the fiscal year ended March 2023. The company incurred an operating loss of Rs 282.1 mn ($3.4 mn).

Listed on the Bombay Stock Exchange as WESL, Websol Energy has a market capitalisation of Rs 3.30 bn ($40 mn). The company’s stock has dropped by 4.4% in the past year. It has a PB ratio of 1.72.

Editor’s note: All stock movement figures as of July 10, 2023.

Australia

Australia China

China India

India Indonesia

Indonesia Japan

Japan Malaysia

Malaysia Philippines

Philippines Singapore

Singapore South Korea

South Korea Taiwan

Taiwan Thailand

Thailand Vietnam

Vietnam