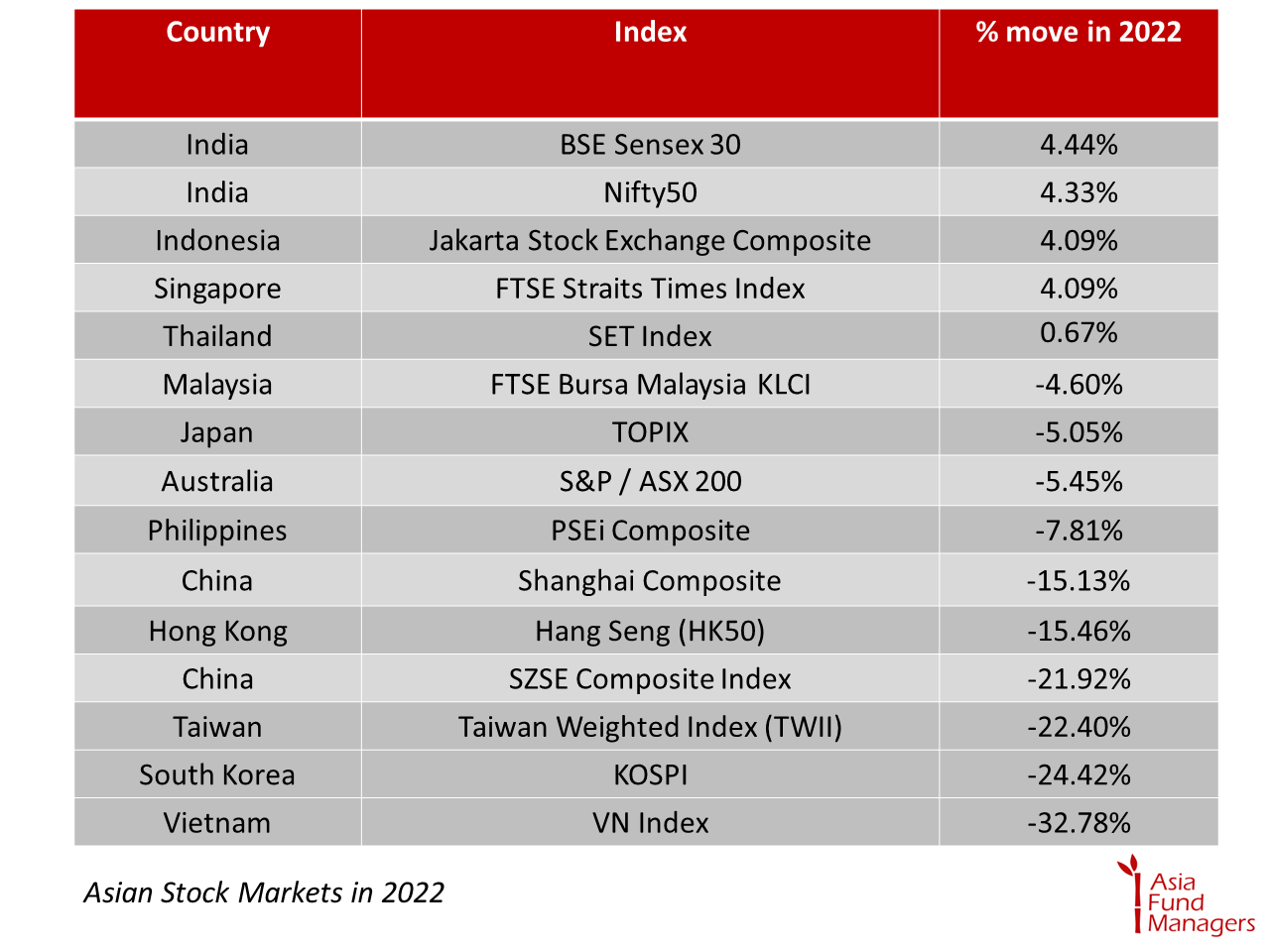

Asian equities fared better than most of the world in 2022, but there are diverging performances within Asia’s stock market. Among the few markets that delivered returns, India has emerged as an outperformer in the region, with benchmark index Nifty 50 eking out 4.33% growth.

China, Hong Kong, South Korea, Taiwan and Vietnam were among the worst-performing Asian stock markets of 2022, declining in double digits over the past year. The reason for the underperformance is varied across the countries, with China impacted by zero-Covid, property crisis and regulatory crackdowns, South Korea and Taiwan seeing a hit from declining chip demand and exports, while Vietnam equities are responding to the government’s anti-corruption crackdown and fears of a recession.

Asia stock market performance

The MSCI AC Asia Pacific Index, which tracks large and mid-cap firms across developed and emerging economies in Asia, declined 19.36% in 2022.

Asia’s stock market had had a turbulent year, starting with the Russian invasion of Ukraine, rising inflation and interest rate hikes, declining demand, and most recently the resurgence of Covid-19 in China. The overall outlook for Asia equities going into 2023 is a mixed bag, but attractive valuations may provide opportunities to investors.

India was the best-performing Asian stock market, making investors richer by nearly $200 bn in the past year. Foreign investors stayed away from emerging markets to uncertainty and high volatility in emerging markets, with Indian equities experiencing a sell-off by foreign institutional investors, but domestic institutional investors picked up the slack and helped the market stay afloat.

The economy is also fairly shielded from a decline in global demand, as India’s exports are a meagre 2.1% in worldwide trade. The country also saw retail inflation ease to an 11-month low of 5.88% in November.

“I would say there are two main factors one there’s the biggest share of domestic investments in Indian Equity markets since ever before. To give you a sense domestic institutions plus domestic retail today account for 22% of India’s market cap while foreigners account for only 18% this is significantly different from the position, let’s say, even five or six years ago where foreign holdings of Indian stocks made a big difference to the direction of Indian equity markets,” Praveen Jagwani, CEO of UTI International, said in an interview with AsiaFundManagers.

India’s growth outlook is intact going into 2023, but equity markets may come under pressure due to inflation, interest rate hikes and oil prices.

Elsewhere in Asian stock markets, only Indonesia and Singapore managed to come close to India’s performance. Vietnam was the biggest loser, along with Taiwan, South Korea, China and Hong Kong.

Australia

Australia China

China India

India Indonesia

Indonesia Japan

Japan Malaysia

Malaysia Philippines

Philippines Singapore

Singapore South Korea

South Korea Taiwan

Taiwan Thailand

Thailand Vietnam

Vietnam