The recent banking crisis hurt investor sentiment out of fear of a 2008-like global financial crisis, amid the already tough macroeconomic conditions. Asian stocks have come under pressure but have still managed to eke out gains in 2023.

The MSCI AC Asia-Pacific Index, which tracks large and mid-caps across five developed and eight emerging markets within the Asia Pacific region, has risen 2.72% year-to-date as of April 28. However, the MSCI World Index has posted over 8% gains during the first four months of 2023.

After the SVB collapse, market participants were expecting the US Federal Reserve to end the rate hike cycle to ease banking stress. However, ING said in a note that another 25bps hike from the Fed is expected. Asian markets have declined by over 1% in April as inflation and recession worries weighed.

Most Asian markets have already paused their rate hike cycle as inflation has likely peaked and even retreated in some economies. After the end of the first quarter of 2023, Asian stock investors are keeping an eye on the economic data and company results coming out in recent weeks.

China’s GDP expanded by 4.5% during the first quarter, demonstrating the economic recovery and the rise in consumer spending in the country. Analysts believe China’s recovery will be key to Asia’s growth in 2023.

However, the global economic slowdown has dented trade in Asia. Vietnam’s manufacturing sector has come under pressure due to sluggish overseas demand.

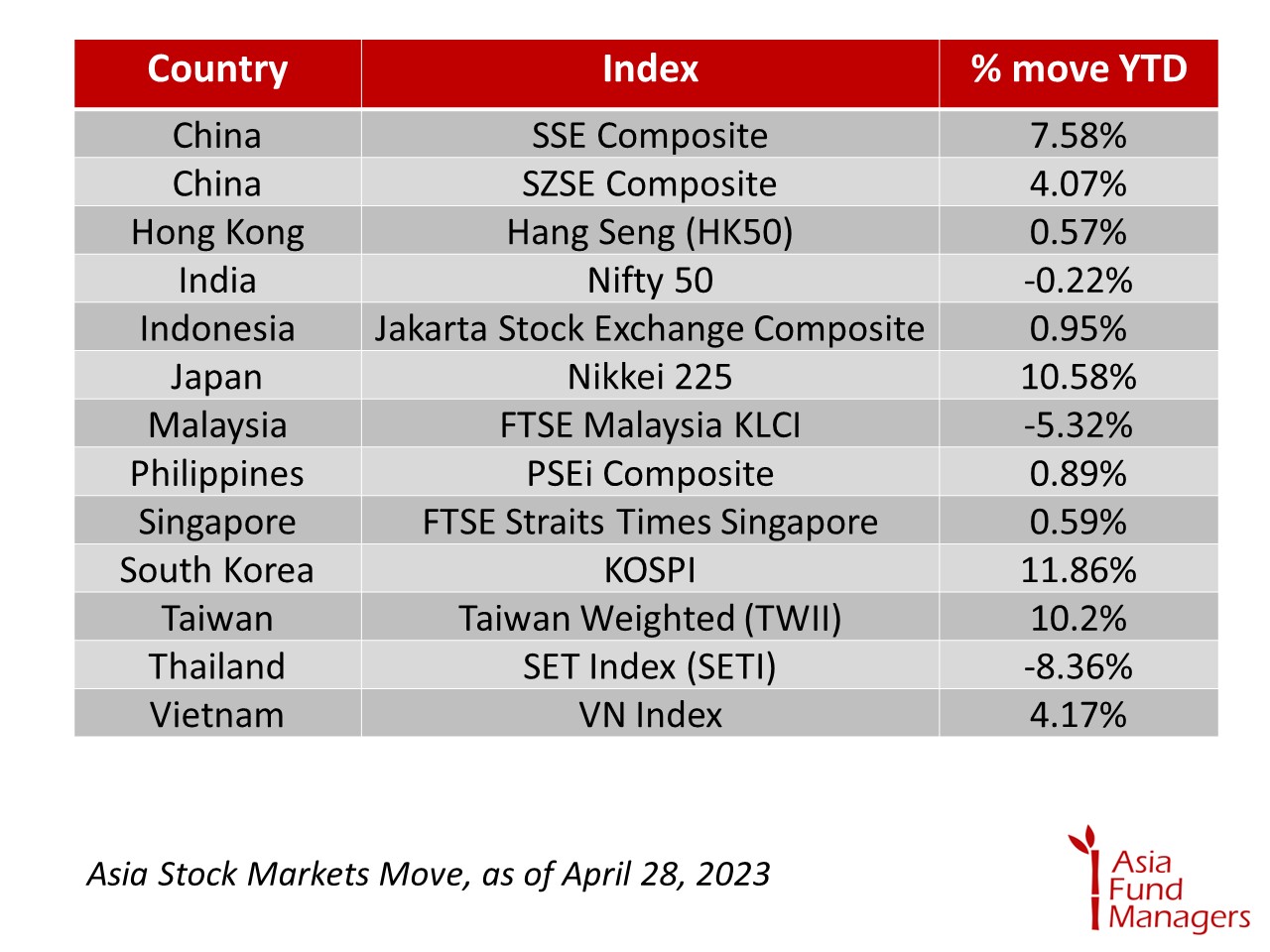

While most Asian economies seem to have dealt with inflation and are nearing the end of rate hikes, Thailand has been an outlier and inflation concerns have dragged stocks lower. Within Asian stock markets, Thailand equities have been the worst performers for the year so far.

China’s equity market has recovered significantly since the start of the year; however, Hong Kong stocks have gained just over half a percent.

Except for India, Malaysia and Thailand, all equity markets in Asia posted gains. South Korea, Japan and Taiwan have been the top performers in the region.

Australia

Australia China

China India

India Indonesia

Indonesia Japan

Japan Malaysia

Malaysia Philippines

Philippines Singapore

Singapore South Korea

South Korea Taiwan

Taiwan Thailand

Thailand Vietnam

Vietnam