According to a United Nations Economic and Social Commission for Asia and the Pacific report, Asia Pacific was the largest destination for foreign investments in 2019. While there seems to be ample investor interest, financial market information from Asia is still largely elusive and difficult to find.

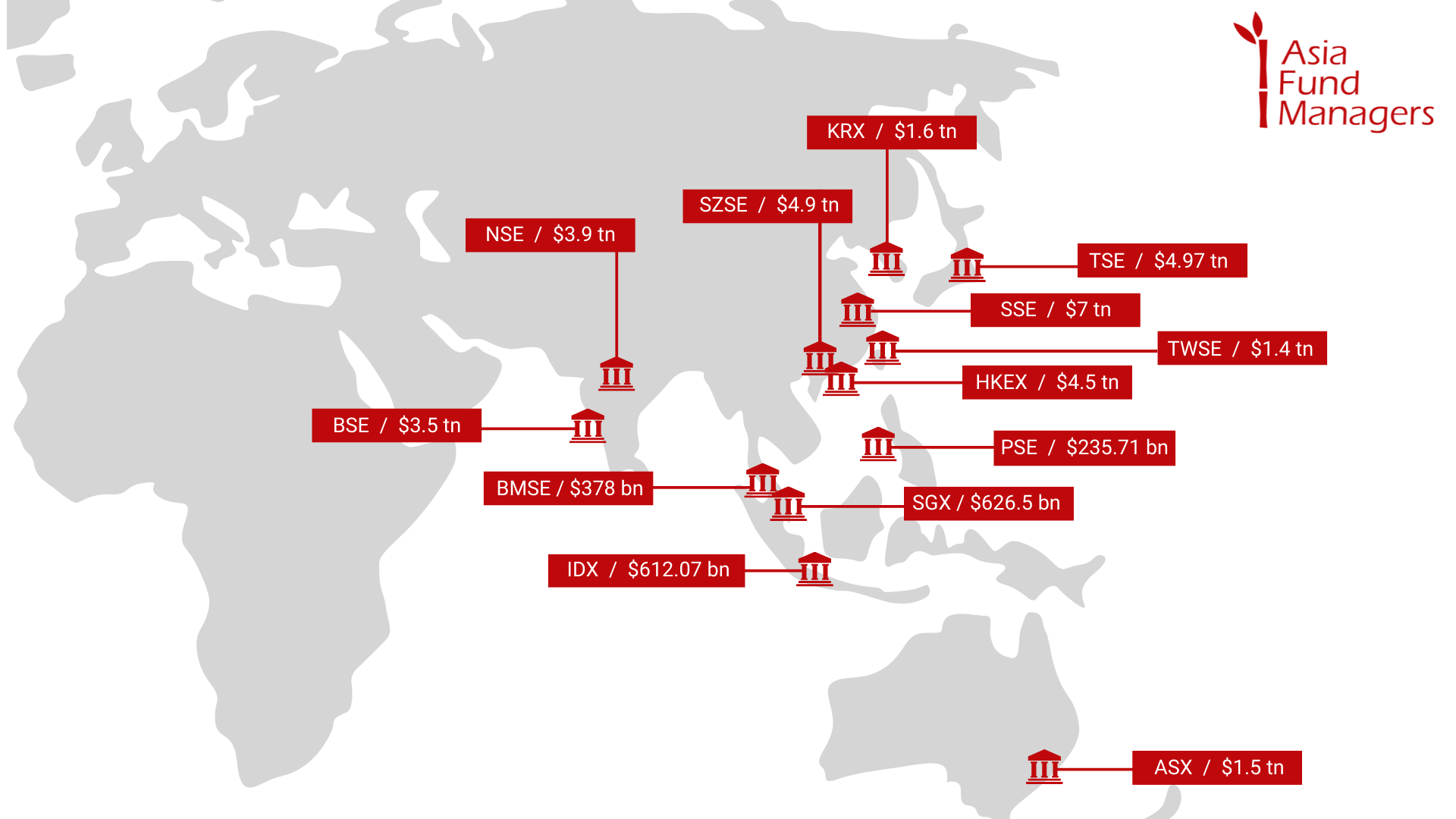

Below we look at the most significant stock exchanges in Asia.

Shanghai Stock Exchange

| Total market cap: | $7 trillion |

| No of listed companies: | 2,163 |

| Benchmark Index: | Shanghai Stock Exchange Composite Index (SHCOMP) |

| Top sectors: | Manufacturing, IT services, Wholesale & retail |

| Top 5 companies: | Kweichow Moutai, ICBC, China Merchants Bank, Agricultural Bank of China, PetroChina |

| Location: | Shanghai, China |

Founded in 1990, the Shanghai Stock Exchange (SSE) is the third largest exchange in the world and lists financial products such as stocks, bonds, funds and derivatives. SSE is directly regulated by the China Securities Regulatory Committee. The primary currency for trade is the Chinese yuan. In 2019, the exchange launched the SSE STAR Market (a science and technology innovation board) to provide better access to sci-tech firms.

Tokyo Stock Exchange

| Total market cap: | $4.97 trillion |

| No of listed companies: | 3,762 |

| Benchmark Index: | Tokyo Stock Price Index (TOPIX) |

| Top sectors: | Electric appliances, Information & Communication, Transport Equipment |

| Top 5 companies: | Toyota Motor Corp, Sony Group Corp, Keyence Corp, MUFG Inc., Softbank Group Corp. |

| Location: | Tokyo, Japan |

Tokyo Stock Exchange (TSE) was first established in 1878, but the current exchange was formed by a merger between the Tokyo Stock Exchange Group and Osaka Securities Exchange in 2013. The holding company, Japan Exchange Group, was set up in response to the merger and was listed on TSE in 2013.

Shenzhen Stock Exchange

| Total market cap: | $4.9 trillion |

| No of listed companies: | 2,648 |

| Benchmark Index: | Shenzhen Stock Exchange Composite Index (SZCOMP) |

| Top sectors: | Manufacturing, IT, Finance |

| Top 5 companies: | CGN Power, BOE Technology, Shenwan Hongyuan, Ping An, CCOOP Group |

| Location: | Shenzhen, China |

Shenzhen Stock Exchange was established in 1990 and is regulated under guidelines set by China Securities Regulatory Commission. SZSE’s products include A-shares, B-shares, indices, mutual funds, fixed income products, and diversified derivative financial products. In 2021, SZSE starts preparation for the merger between the Mainboard and the SME Board.

Hong Kong Stock Exchange

| Total market cap: | $4.5 trillion |

| No of listed companies: | 2,577 |

| Benchmark Index: | Hang Seng Index (HSI) |

| Top sectors: | Finance, Tech media telecom (TMT), Retail trade |

| Top 5 companies: | Tencent, China Construction Bank Corp, China Mobile, HSBC, AIA Group. |

| Location: | Central District, Hong Kong |

Hong Kong Exchanges and Clearing Limited (HKEX) was established in 1999 by merging The Stock Exchange of Hong Kong Limited (SEHK), Hong Kong Futures Exchange Limited (HKFE) and Hong Kong Securities Clearing Company Limited (HKSCC). HKEX acts the overseas hub for foreign investors interested in mainland China companies. In recent months China has tried to affirm Hong Kong’s role as the offshore hub for Chinese equities through various policy changes.

Bombay Stock Exchange

| Total market cap: | $3.5 trillion |

| No of listed companies: | 5,595 |

| Benchmark Index: | Sensex |

| Top sectors: | Banks, Finance, IT |

| Top 5 companies: | Reliance Industries, Tata Consultancy Services, HDFC Bank, Infosys, ICICI Bank |

| Location: | Mumbai, India |

The Bombay Stock Exchange, now known as the BSE, is Asia’s first stock exchange and was established in 1875 under a tree. The exchange facilitates trading in equity, currencies, debt instruments, derivatives, and mutual funds. BSE’s investor count crossed the 100-million mark earlier this year, with the number of registered investors growing 58% in a year.

National Stock Exchange, India

| Total market cap: | $3.9 trillion |

| No of listed companies: | 2,049 |

| Benchmark Index: | Nifty50 |

| Top sectors: | Banks, Finance, IT |

| Top 5 companies: | Reliance Industries, Tata Consultancy Services, HDFC Bank, Infosys, Hindustan Unilever |

| Location: | New Delhi, India |

The National Stock Exchange (NSE) was set up in 1992 and is regulated under the guidelines of the Securities & Exchange Board of India (SEBI). Based out of Delhi, the exchange offers 3 asset classes for trading: capital market for the listing and trading of equities, fixed income securities and the derivatives market.

Korea Exchange

| Total market cap: | $1.6 trillion |

| No of listed companies: | 2,524 |

| Benchmark Index: | Korea Composite Stock Price Index (KOSPI) |

| Top sectors: | Electronic Technology, Producer Manufacturing, Health technology |

| Top 5 companies: | Samsung, SK Hynix, LG Energy Solutions, NAVER, Samsung Biologics |

| Location: | Busan and Seoul, South Korea |

Korea Stock Exchange (KSE) was established in 1956 as The Daehan Stock Exchange, and Korea Exchange (KRX) was formed in 2005 by the consolidation of KSE, Korea Securities Depository and Korea Futures Exchange. KRX is governed by the rules set under Korea Stocks & Futures Exchange Act.

Australia Stock Exchange

| Total market cap: | $1.5 trillion |

| No of listed companies: | 2,317 |

| Benchmark Index: | S&P/ASX 200 |

| Top sectors: | Energy, IT, Materials |

| Top 5 companies: | BHP, Commonwealth Bank, CSL, Nat Bank Macquarie Group |

| Location: | Sydney, Australia |

ASX or the Australian Securities Exchange was created in 2006 by the merger of the Australian Stock Exchange and the Sydney Futures Exchange. ASX is an integrated exchange offering listings, trading, clearing, settlement, technical and information services, technology, data and other post-trade services.

Taiwan Stock Exchange

| Total market cap: | $1.4 trillion |

| No of listed companies: | 948 |

| Benchmark Index: | Taiwan Capitalization Weighted Stock Index (TWSE) |

| Top sectors: | Semiconductor, Finance and Insurance, Computer and Peripheral Equipment |

| Top 5 companies: | Taiwan Semiconductor Manufacturing, Hon Hai Precision Industry, Mediatek, Formosa Petrochemical, Chunghwa Telecom |

| Location: | Taipei, Taiwan |

Taiwan Stock Exchange (TWSE) was established in 1961 and currently lists include stocks, convertible bonds, beneficial certificates, call (put) warrants, ETFs, ETNs, Taiwan Depository Receipts (TDRs), beneficiary securities (REITs), etc.

Singapore Exchange

| Total market cap: | $626.5 billion |

| No of listed companies: | 661 |

| Benchmark Index: | Straits Times Index (STI) |

| Top sectors: | Financials, Industrials, Consumer services |

| Top 5 companies: | OCBC, UOB, SingTel, Nippon Pain, Wilmar International |

| Location: | SGX Centre, Singapore |

Singapore Exchange (SGX) is Asia’s most international, multi-asset exchange, with about 40% of listed companies and 80% of listed bonds originating outside Singapore. SGX was set up in 1999 and is known for its risk management and clearing capabilities.

Indonesia Stock Exchange

| Total market cap: | $612.07 billion |

| No of listed companies: | 795 |

| Benchmark Index: | Finance, Infrastructure, Non cyclicals |

| Top sectors: | Jakarta Stock Exchange Composite Index |

| Top 5 companies: | Bank Central Asia, Bank Rakyat Indonesia, Telekomunikasi Indonesia, Bank Mandiri, Astra International |

| Location: | Jakarta, Indonesia |

Indonesia’s first stock exchange was built in Jakarta (then known as Batavia) by the Dutch East Indies in 1912. The Indonesia Stock Exchange was shut down several times during the World Wars and capital markets were properly opened only in 1977 by the Indonesian government.

Bursa Malaysia

| Total market cap: | $378 billion |

| No of listed companies: | 984 |

| Benchmark Index: | FTSE Bursa Malaysia |

| Top sectors: | Financial services, Consumer products and services, Industrial Products & Services |

| Top 5 companies: | Malayan Banking, Public Bank, IHH Healthcare, Tenaga Nasional, CIMB Group |

| Location: | Kuala Lumpur, Malaysia |

Bursa Malaysia was established in 1976 and is among the largest bourses in ASEAN. Its product range includes equities, derivatives, offshore and Islamic assets as well as Exchange Traded Funds (ETFs), Real Estate Investment Trusts (REITs) and Exchange Traded Bonds and Sukuk (ETBS). The group teamed up with FTSE Group in 2006 for separate indices.

Philippine Stock Exchange

| Total market cap: | $235.71 billion |

| No of listed companies: | 279 |

| Benchmark Index: | Philippine Stock Exchange Index (PSEi) |

| Top sectors: | Financials, Industrials, Holding firms |

| Top 5 companies: | SM Investments Corp, Ayala Corp, BDO Unibank, PLDT, Metropolitan Bank & Trust |

| Location: | Manila, Philippines |

The Philippine Stock Exchange (PSE) was formed after the country’s two former stock exchanges, the Manila Stock Exchange (MSE) and the Makati Stock Exchange (MkSE), were merged. Both the exchanges traded the same stocks of the same companies and were consolidated in 1992.

All numbers as of September 6, 2022.

Australia

Australia China

China India

India Indonesia

Indonesia Japan

Japan Malaysia

Malaysia Philippines

Philippines Singapore

Singapore South Korea

South Korea Taiwan

Taiwan Thailand

Thailand Vietnam

Vietnam