Financial markets in Asia-Pacific have had a great start into 2023, despite inflation and high-interest rates biting into economic growth. Asian markets are benefiting from the waning fears of a deep US recession, in addition to the reopening of China which has bolstered investor sentiment.

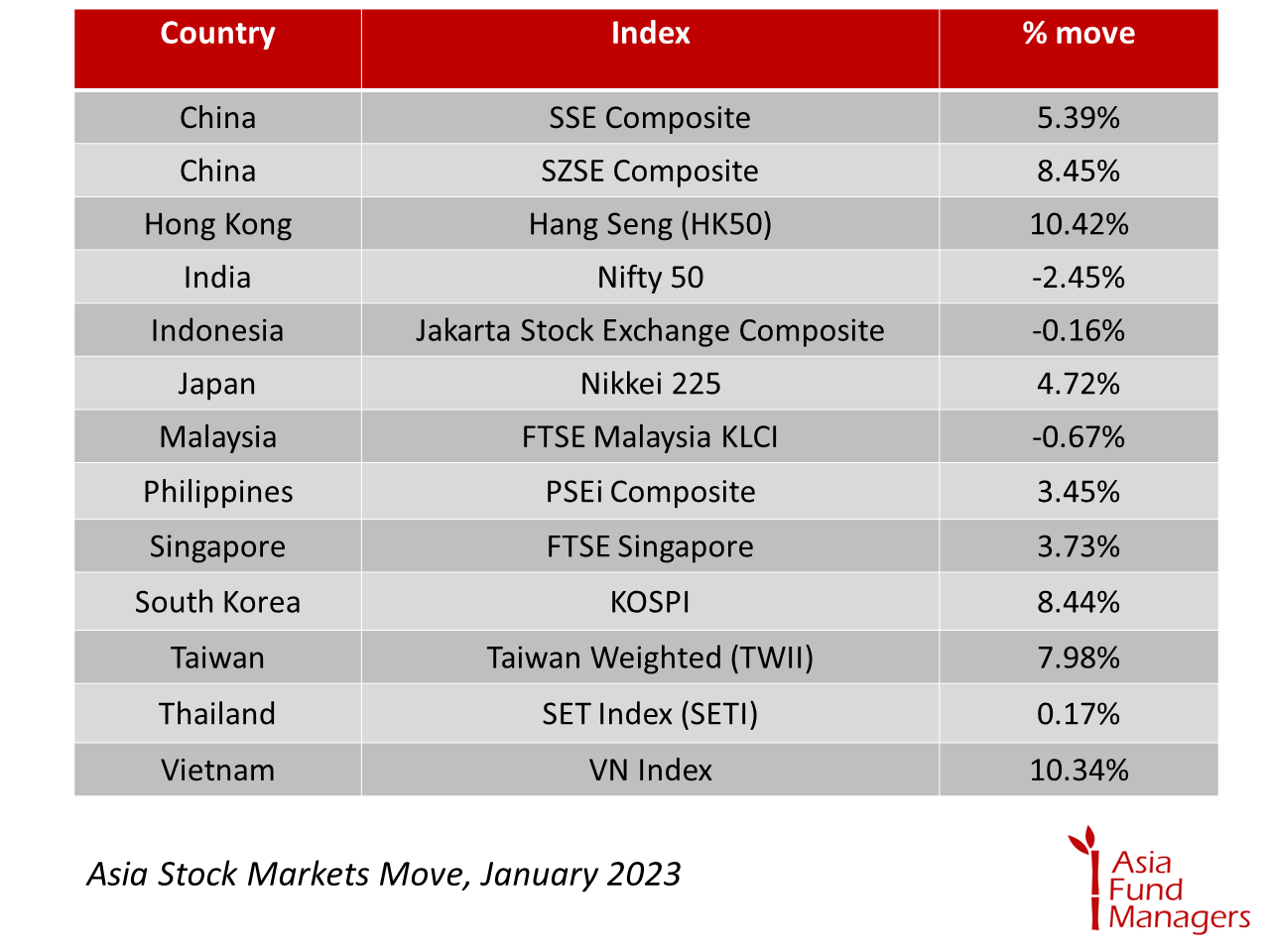

The MSCI AC Asia Pacific Index (MIAP00000PUS), which tracks large and mid-cap firms across five developed markets and eight emerging market economies, rose 7.84% in the first month of 2023.

How did Asian markets do?

Market experts around the world have been saying that inflation has peaked, but central banks are still far from scaling down their key interest rates.

In its monthly market review, J.P. Morgan Asset Management writes, “Developed market central banks will face a more challenging economic backdrop in 2023, which could raise the risk of policy errors. Inflation is decelerating, but should still take time to return to target, requiring high rates to stay. Yet, growth momentum is slowing.”

Growth has slowed in Asia, and the IMF in its recent outlook update said that it sees inflation and high-interest rates cutting the growth of Asian economies.

Back in November, Beijing announced a slew of measures to shore up its economy, which has been hit by the property crisis and the zero-Covid rules. The policy shift led to a rally in indices in the mainland as well as Hong Kong. Additionally, the reopening of borders by China, Japan and other Asian economies has helped the tourism industry, which J.P. Morgan says could offset some of the exports weakness.

On the other hand, Principal AM says that the US Federal Reserve and the European Central Bank have resolved to bring inflation under control. In this scenario, “We remain positive on Asian equities. We will also continue to focus on quality companies which have good earnings visibility, robust balance sheet, long term winners, market share gainers and those with pricing power to overcome cost pressures,” writes Principal AM.

Additionally, the recent Lunar New Year in China aided investor confidence as domestic consumption ticked up across certain economies.

Indian equity markets saw a hiccup in the latter half of the month, as the fraud allegation by Hindenburg Research on Adani Group sapped off the appetite for foreign investors. As at the time of writing, shares of Adani companies have seen a wipe-out of $92 bn.

Here is a summary of the performance of Asian equity markets in the first month of the new year.

Australia

Australia China

China India

India Indonesia

Indonesia Japan

Japan Malaysia

Malaysia Philippines

Philippines Singapore

Singapore South Korea

South Korea Taiwan

Taiwan Thailand

Thailand Vietnam

Vietnam