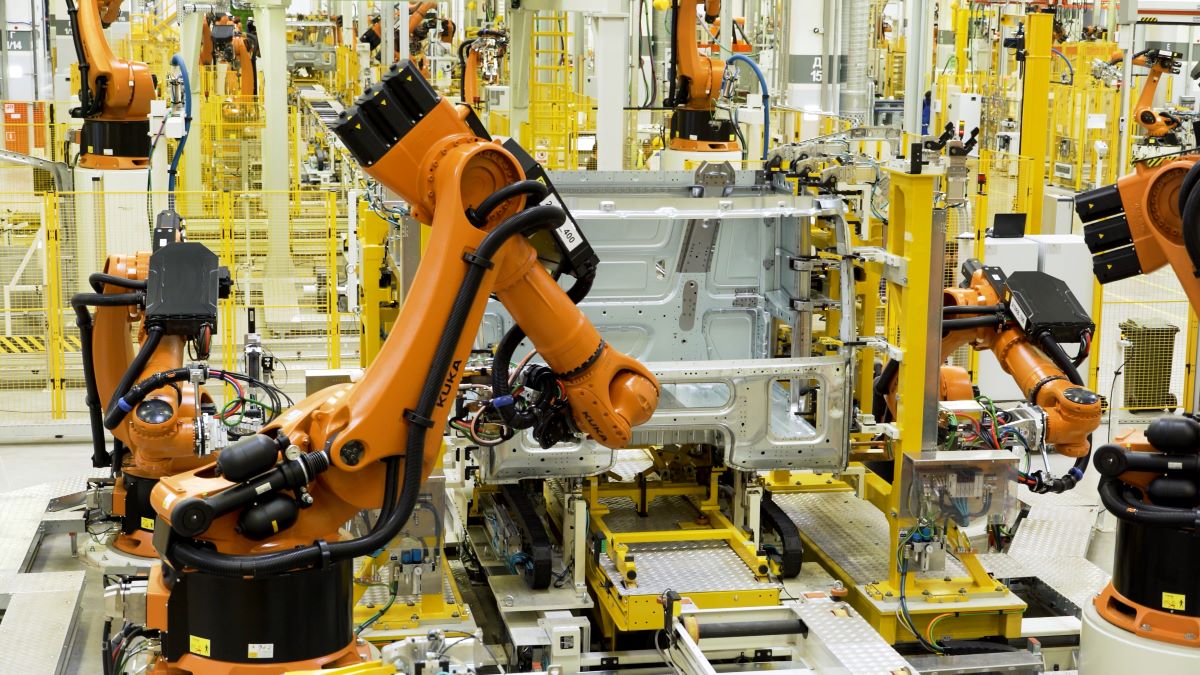

The robotics boom has been a major driving force for the stock rally in Japan in the first half of 2023. Japanese robotics and automation companies have emerged as one of the strong performers this year.

Japan’s dominance in the robotic sphere is not a new phenomenon. Since the 1980s, industrial robots have been a significant reason behind the nation’s economic clout. In fact, 1980 is also known as the ‘year one’ of the robotics era in Japan.

According to the International Federation of Robotics (IFR), the nation commands a global market share of 46% in industrial robot manufacturing. “Exports of Japanese industrial robots on average had a compound annual growth rate of 6% in the last five years,” said the President of IFR, Milton Guerry. Recent data by the industry body reveals that Japan’s industrial robot exports touched a new peak of 207,737 units in 2022, bringing its export ratio to 81%. The weakening of the yen has also been beneficial for robotics exports.

In recent years, Japanese robot and automation suppliers have ramped up their production capacity and set up manufacturing sites in other countries too. The intense Covid-crisis in China has also tilted the beam in favour of Japanese robot manufacturers who are supplying directly to China.

Moreover, due to the shrinking labour force and the rapidly aging population in Japan, companies began to propose increased automation solutions as well as automation equipment such as robots.

One of the main reasons behind Japan’s unchallenged position in the global robotics and automation space is the constant government support. In 2017, the Japanese government launched the “Connected Industries” strategy to promote smart factories. This included financial support for the systems, sensors, robots, and other equipment for productivity through data collaboration and utilisation.

Top Japanese robotics and automation stocks to consider

Increased demand for automation is likely to fuel the growth of industrial robotics over the long term. With Japan at the helm of robotics, investors can look at these four robotics and automation stocks to capture the growth.

Keyence Corporation

One of the leading industrial automation companies, Keyence Corporation manufactures code readers, machine vision systems, microscopes, measuring systems, laser markers, and sensors. The primary client base of Keyence comprises semiconductors, automobiles, and home appliance sectors. Headquartered in Osaka, Keyence also has warehouse facilities across Asia, Europe, and the Americas.

The company saw a 19.3% year-on-year increase in its operating profit, reaching 498.9 bn yen ($3.32 bn) in the fiscal year ended March 2023. During this same period, Keyence Corporation’s revenue witnessed a 22.1% year-on-year rise, amounting to 922.4 bn yen ($6.14 bn).

Keyence Corporation, with a market capitalisation of 12.699 tn yen ($85 bn), has its shares traded on the Tokyo Stock Exchange (6861.T). Over the past year, the company’s stock has experienced a 9.96% surge. Keyence Corporation shares have a price-to-earnings ratio of 34.48 and a price-to-book ratio of 5.22.

SMC Corporation

Headquartered in Tokyo, SMC Corp is involved in the manufacturing and marketing of industrial automation devices and control equipment alongside sintered filters and other filtration equipment. The company has production facilities in several Japanese cities like Tsukuba, Yamatsuri, Soka, Shimotsuma, Tono, and Kamaishi. Besides Japan, SMC also has technical development centers in the US, Europe, and China.

The company saw a 13.3% year-on-year increase in its operating profit, reaching 258.2 bn yen ($1.72 bn) in the fiscal year ended March 2023. During this same period, SMC Corporation’s revenue witnessed a 13.4% year-on-year rise, amounting to 824.8 bn yen ($5.49 bn).

SMC Corporation, with a market capitalisation of 4.412 tn yen ($29 bn), has its shares traded on the Tokyo Stock Exchange (6273.T). Over the past year, the company’s stock has experienced a 21.24% surge. SMC Corporation shares have a price-to-earnings ratio of 22.06 and a price-to-book ratio of 2.30.

Fanuc Corporation

Fanuc or Fuji Automatic Numerical Control manufactures a wide array of robot models with differentiated features for the automotive, aerospace, consumer goods and education sectors. Its factories are in Yamanashi and Kagoshima, but it also has operations in Americas, Europe, and South Africa.

Fanuc’s robot division is in the growth stage and the company noted that the operating margin of this division is gradually improving. In August 2023, FANUC witnessed a major milestone of shipping a cumulative 1 million industrial robots since 1977.

For the fiscal year ending March 2023, the company saw a year-on-year increase of 16.2% in its revenue earnings, reaching 852 bn yen ($5.67 bn). During that same period, its operating profit came in at 191.4 bn yen ($1.27 bn), clocking in a 4.4% growth.

Fanuc shares are traded on the Tokyo Stock Exchange (6954.T). The company currently holds a market capitalisation of 3.473 tn yen ($23 bn). In the 6 months period between October 2022 to March 2023, Fanuc stock has experienced a rise of 13.5%. On March 31, 2023, the company underwent a 5-1 stock split, after which it posted a 23% drop till October 26, 2023. Additionally, its shares are characterised by a PE ratio of 21.93 and a price-to-book ratio of 2.22.

Yaskawa Electric Corporation

Yaskawa Electric is predominantly an electric equipment manufacturer, but it also has an eminent robotics line. Through Yaskawa Motoman, the company delivers high-quality industrial robots alongside fully integrated robotic automation systems. These robots are used for almost all industrial activities including welding, cutting, picking, and palletising. The company has operations across Americas, Europe, Asia-Pacific, the Middle East, and Africa.

For the fiscal year ending February 2023, the company’s operating income climbed 29.2% over the year to 68.3 bn yen ($0.45 bn). Additionally, Yaskawa Electric Corporation saw a year-on-year revenue increase of 16%, totalling 556 bn yen ($3.70 bn).

With a market capitalisation of 1.295 tn yen ($8.6 bn), the company is listed on the Tokyo Stock Exchange (6506.T). Its shares surged 24.8% over the past one year. Yaskawa Electric boasts a PE ratio of 24.77 and a price-to-book ratio of 4.20.

Editor’s note: All stock movement figures as of October 26, 2023.

Australia

Australia China

China India

India Indonesia

Indonesia Japan

Japan Malaysia

Malaysia Philippines

Philippines Singapore

Singapore South Korea

South Korea Taiwan

Taiwan Thailand

Thailand Vietnam

Vietnam