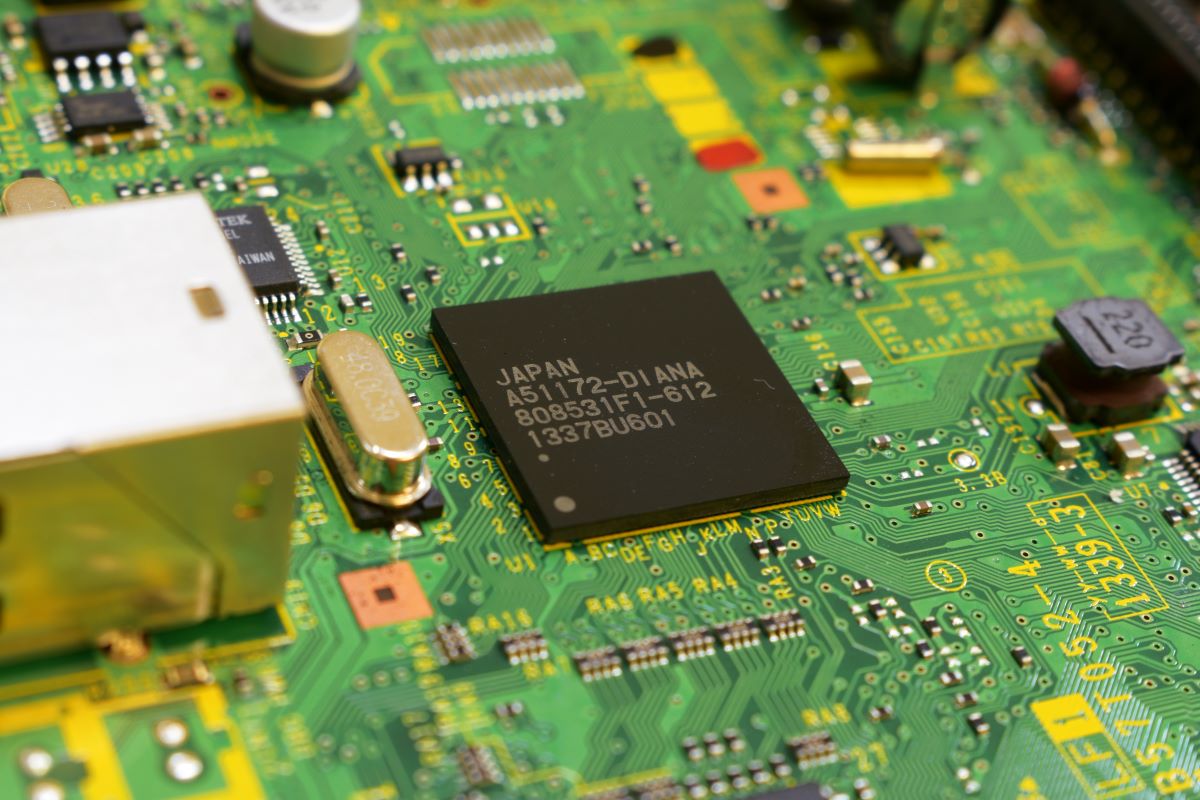

Recognising the potential of the semiconductor industry, Japan has planned to scale up its chip-making prowess. The Japanese government has introduced policies laying focus on the security and revitalisation of chip supply chains, aiming to promote the use of new technology and strengthen wider cooperation.

The Ministry of Economy, Trade and Industry (METI) has dedicated an amount of $2.8 bn from the fiscal 2022 budget to fund subsidies allocated for chip companies, which applies to both domestic and overseas chipmakers investing in Japan. To be eligible, companies should continue producing in Japan for 10 years. The subsidies make up one-third of capital investment in power chips that regulate currents in EVs and microcontrollers managing auto steering and analog semiconductors.

To boost budget funding for public-private investment in the semiconductor sector, the METI came up with Semiconductor and Digital Industry Strategy, in 2021.

Semiconductors are identified as a “specified critical material” according to Japan’s Economic Security Promotion Act. Eligible private businesses can avail of support such as subsidies and low-interest loans for producing raw materials required for semiconductor production.

The policy formulation is mainly based on strategic autonomy and strategic indispensability. The former means achieving Japan’s security objectives without excessive dependence on other countries, while the latter refers to strengthening areas in which Japan already has or can potentially have strengths in the global semiconductor supply chain.

Moves in Japan semiconductor sector

Taiwan’s TSMC, in partnership with Sony Group, is building its first Japanese chip plant in Kumamoto prefecture and mass production is scheduled to be started by the end of 2024. The Taiwanese chip giant has also planned to build a second chip plant in Japan for producing high-end chips of 5 nm and 10 nm.

Rapidus, a chipmaking consortium launched by the METI and major private companies, will receive an additional $1.94 bn from the government.

Japan has provided US chipmaker Micron with a subsidy of $322m for producing advanced memory chips at a factory in Hiroshima.

Taro Fujie, CEO of Ajinomoto (a food company which is also developing an important material used in semiconductors), said that the company may add a new manufacturing base to produce more of the specialized material. Ajinomoto may invest more than its planned $186m if necessary.

Advantest, a Tokyo-based company, said it has seen a spike in demand for its chip-testing devices propelled by the craze in ChatGPT and other novel uses of AI.

Japan’s semiconductor and US-China chip war

The importance of the semiconductor industry has led to a chip war between the US and China. Japan is looking to reduce its dependence on China and has joined the US and the Netherlands in restricting exports of semiconductor manufacturing equipment to China. The restriction applies to 23 types of advanced semiconductor manufacturing equipment, including advanced crystal epitaxial growth equipment, photomask coating equipment, deposition equipment, heat treatment equipment, cleaning equipment and lithography stepper.

In 2022, as part of a new economic dialogue, the US and Japan agreed to establish a new research and development organisation for developing a secure source of the vital chip components.

Glenn Youngkin, the Governor of the US state of Virginia, pushed to lure more Japanese chip makers to invest in the American state in an attempt to cut reliance on China.

Japan was once the leader of the semiconductor industry in the 1980s. However, it lost its prominence due to stagnant sales of digital products which resulted in less capital to invest in research and development.

“Japan remains critical to the global semiconductor ecosystem. Its government is keen to re-energise the chip industry to ensure a stable supply, as evidenced by Prime Minister Fumio Kishida’s attendance at the Tokyo SEMICON exhibition in December. The state is also subsidising a new joint venture, named Rapidus, which includes eight major companies, including Sony, SoftBank and Denso. It aims to deliver next-generation 2-nanometre chip technology8, in addition to a project that involves Taiwanese chip manufacturer TSMC expanding its operations in the Kumamoto prefecture,” writes Thomas Patchett, Japanese Equity Specialist, at Baillie Gifford.

Although the country is still a leader in memory chips, sensors and power semiconductors, it is looking to expand further and reclaim its position in the global semiconductor market.

– reporting by Jovan Thomas

Australia

Australia China

China India

India Indonesia

Indonesia Japan

Japan Malaysia

Malaysia Philippines

Philippines Singapore

Singapore South Korea

South Korea Taiwan

Taiwan Thailand

Thailand Vietnam

Vietnam