After a strong start into 2023 during the month of January, most Asian markets posted losses in February as concerns about inflation and a global economic slowdown dampened investor sentiment. China’s reopening shows positive economic data coming out of Beijing, but that has failed to translate into equity gains.

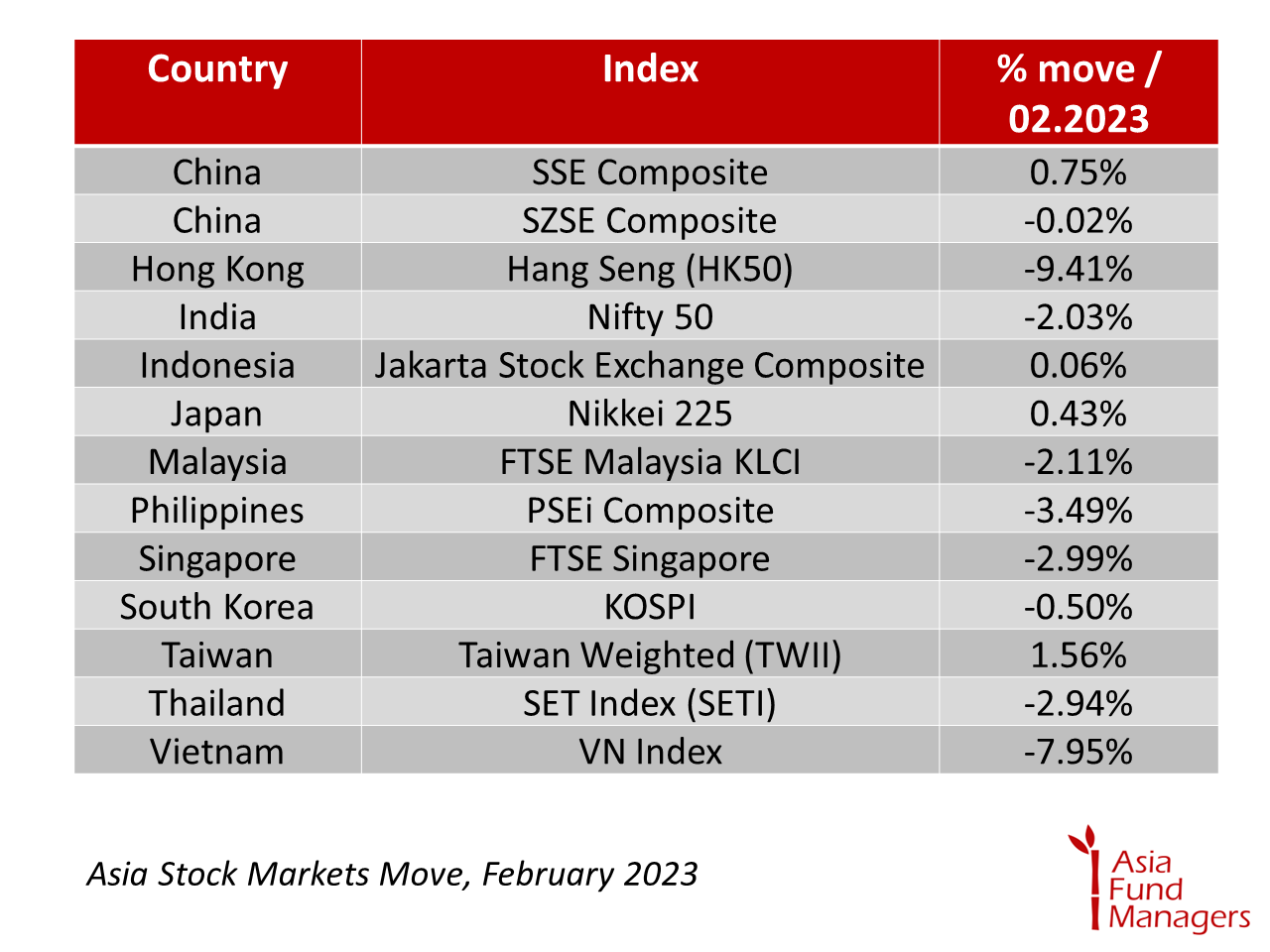

The MSCI AC Asia Pacific Index (MIAP00000PUS), which tracks large and mid-cap firms across Asia’s five developed markets and eight emerging market economies, fell 5.94% in February 2023.

What transpired in Asian markets?

Rising tensions in Ukraine, the strained relations between US and China and the US Federal Reserve’s monetary policy tightening measures saw foreign investors dumping riskier assets. A recent Reuters report cites Refinitiv data to say that Asian equities saw net $6.9 bn of foreign outflows, the second straight month after overseas investors sold $8.4 bn worth of equities in January.

India had the highest share in the region’s foreign outflows ($4.74bn), as the developments in Adani fraud allegations by Hindenburg Research has eroded investor confidence, whereas rising crude oil prices remain a threat to the country’s economic recovery.

On the other hand, emerging markets in Asia remain unattractive as the US Federal Reserve is expected to hike rates further and keep them high for longer.

In its monthly market review, J.P. Morgan Asset Management writes, “The U.S. Federal Reserve is staying hawkish, but investors, including us, still think that the central bank is nearly done with the tightening cycle, with limited damage so far.”

Meanwhile, positive indicators emerged from China economy’s quick recovery from the pandemic. China’s factory output rose at the quickest pace in more than a decade in February, as per official data, exceeding forecasts as production rocketed after the relaxation of the zero-Covid policy.

On the other hand, Indonesia’s 2022 GDP growth was the best in over nine years. Almost half of Indonesia’s GDP comes from consumer spending, and President Joko Widodo (Jokowi) asked Indonesians to spend more to help economic recovery.

Japan’s inflation is steadily rising and the route to recovery is still unclear. Years of yield curve control have created a significant distortion in the Japanese government bond market by aiming the 10-year JGB rate at 0%. The Bank of Japan presently owns more than half of all outstanding JGBs. However, the recent appointment of a new central bank governor has raised hopes of a policy change to control inflationary pressures.

“We remain positive on Asian equities because of China’s economic recovery and the earnings growth in Asia which is anticipated to be stronger than developed markets,” writes Principal AM.

Australia

Australia China

China India

India Indonesia

Indonesia Japan

Japan Malaysia

Malaysia Philippines

Philippines Singapore

Singapore South Korea

South Korea Taiwan

Taiwan Thailand

Thailand Vietnam

Vietnam