Japanese car maker Honda Motor Company and South Korean battery manufacturer LG Energy Solution Ltd. will invest $4.4 bn to set up a joint venture lithium-ion battery manufacturing unit in the United States. Honda is planning to increase its production in America and will be the Japanese carmaker’s first electric vehicle (EV) battery plant.

The move comes in the wake of new legislation, dubbed the Inflation Reduction Act, signed by President Joe Biden. It makes it mandatory for electric vehicle companies to assemble electric vehicles in North America to be eligible for a tax break of up to $7,500 for buyers of new vehicles through 2032.

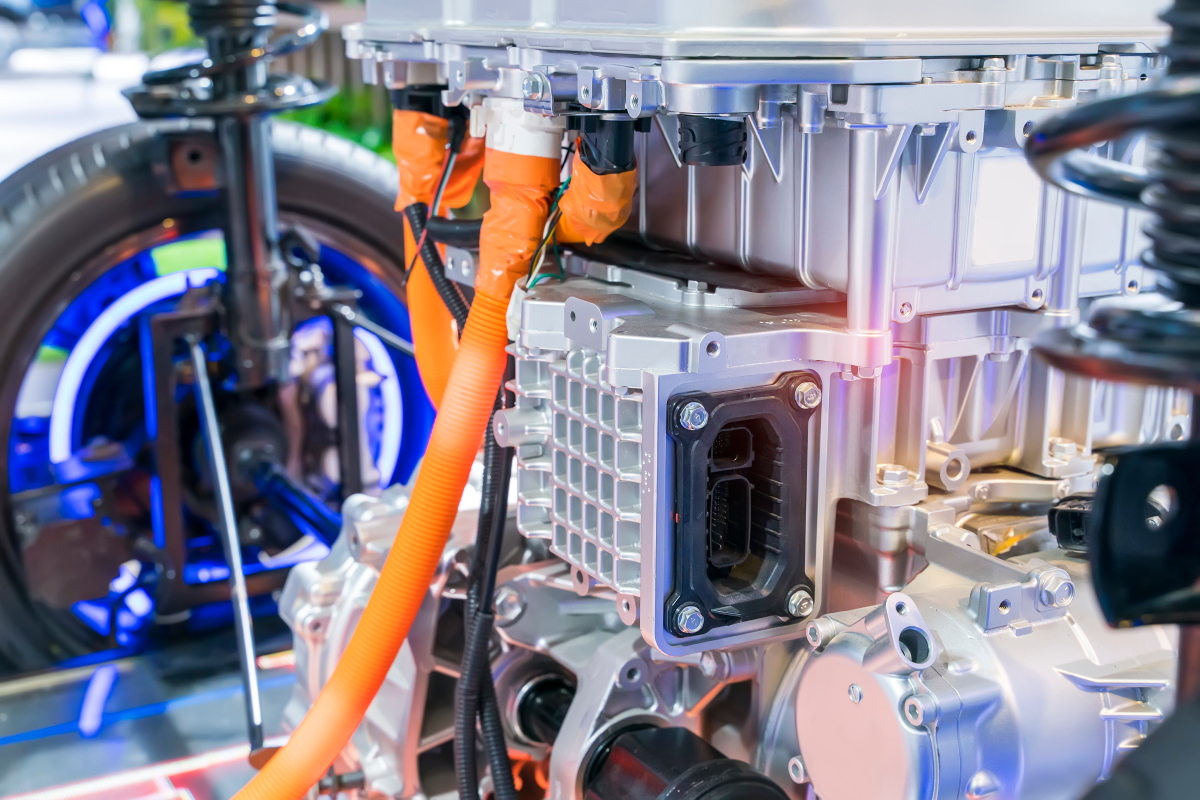

The new battery plant is slated to be operational by the end of 2025 and will have a production capacity of about 40 gigawatt-hours per annum, Honda said this week in a company filing. Construction of the new plant will start in early 2023. Honda will hold a 49% stake in the joint venture by investing $1.7 bn. The new plant will manufacture pouch-type batteries for Honda and Acura’s EVs.

While the location of the proposed joint venture plant is yet to be confirmed, some reports suggest it will come up in Ohio, which already hosts several Japanese automobile plants.

Honda’s EV plans over the next decade

Honda CEO Toshihiro Mibe said Monday that his company plans to invest 5 tn yen ($36 bn) over the next decade to launch about 30 new models. This is said to be among the most aggressive expansions by any Japanese electric vehicle company.

“Honda is working toward our target to realise carbon neutrality for all products and corporate activities the company is involved in by 2050,” Mibe, said in a statement, adding, “Aligned with our longstanding commitment to building products close to the customer, Honda is committed to the local procurement of EV batteries, which is a critical component of EVs. This joint venture with LG Energy will be part of such a Honda approach.”

The United States are a major market for Honda Motors and accounts for over 30% of its global sales.

LG – world’s second-largest EV battery maker

China and South Korea are the leading players in the Asian EV battery market. Next to China’s Contemporary Amperex Technology (CATL), LG Energy Solutions Ltd. enjoys the second-largest share of the battery market globally. The company has already set up a joint venture with General Motors in North America and with Stellantis in Europe.

The annual production capacity of LG Energy Solution for General Motors is 30 gigawatt-hours. The upcoming joint venture with Honda Motors is also likely to be on the same scale. The expansion will enable LG Energy to supply batteries to 500,000 to 600,000 standard electric vehicles.

Rush to build electric battery plants in North America

The strings attached to EV incentives in the new US legislation have been worrying Japanese electric vehicle companies. Many Japanese electric vehicle companies are struggling to come from behind in electric cars as they do not make any EVs or plug-in hybrid vehicles in North America. EV companies from across the world are now partnering with battery manufacturers in Japan to set up joint ventures in North America.

Wall Street Journal reported last week that Panasonic Holdings Corp., the Japanese EV maker that supplies batteries to Tesla Inc., is currently in talks to invest $4 bn in a battery plant in the US.

Meanwhile, South Korean officials are set to meet with representatives from the US Trade Representative’s office and the US Treasury this week to express “concerns” over the negative impacts from the Inflation Reduction Act. Hyundai Motor Company is reportedly considering starting construction of an EV and battery manufacturing plant in the US earlier than originally planned for 2023.

Australia

Australia China

China India

India Indonesia

Indonesia Japan

Japan Malaysia

Malaysia Philippines

Philippines Singapore

Singapore South Korea

South Korea Taiwan

Taiwan Thailand

Thailand Vietnam

Vietnam