In 2021, US internet stocks reached record highs while Asian peers underperformed massively, mainly on account of falling shares of Chinese internet companies. The internet sector in Asia retreated further in the beginning of 2022 but the gap to the US has narrowed of late. Have Chinese internet stocks finally hit rock bottom, meaning the long-awaited trend reversal is now happening? Roger Merz, Head of mtx Portfolio Management and Alex Stauffacher, Equity Analyst, at Vontobel Asset Management, with a market assessment.

One of the main reasons for the slump in Chinese internet names was tighter oversight. The calling-off of Ant Group’s initial public offering (IPO) in late 2021 was a first sign of increased scrutiny. The authorities later tightened the screws on financial technology companies, banned internet-enabled for-profit tutoring for Chinese students, released a slew of new rules for online games (limits on the time minors can spend playing) and media content (curb on celebrity fan culture, denouncing parts of the business as “money worship”). There were also data privacy (customers able to block targeted advertising) and anti-trust issues (authorities pushing to open-up ecosystems, which could lower prospects for internet incumbents). All this depressed economic growth and investor sentiment.

Regulation of big technology companies in Europe and the US was tightened much earlier than in China, but authorities in the west often apply a lighter touch. As a result, internet stocks in developed markets could ride the post-Covid wave of digitalization and cloud transformation with the MSCI Communication Services Index, for instance, rising 13% in 2021 versus a loss of 10% for the respective emerging market benchmark, with Chinese internet blue chips Tencent and Baidu declining 19% and 31%, respectively.

The Chinese internet sector started to stabilize in early 2022 after the Chinese leadership signaled a policy shift to economic growth last December, dropping mentions of “anti-monopoly efforts” or “curbs on the disorderly expansion of capital” that had featured in a document from the previous year. In the course of 2022, China’s “zero Covid” stance and its dampening effect on economic activity, as well as increasing global recession fears, led to another round of sell-offs – this time hurting US stocks even more than Chinese ones. Since the beginning of the year through June 15, the communication services index for developed markets lost 27% with the same index in emerging markets down by “only” 17%.

High valuations came before the fall

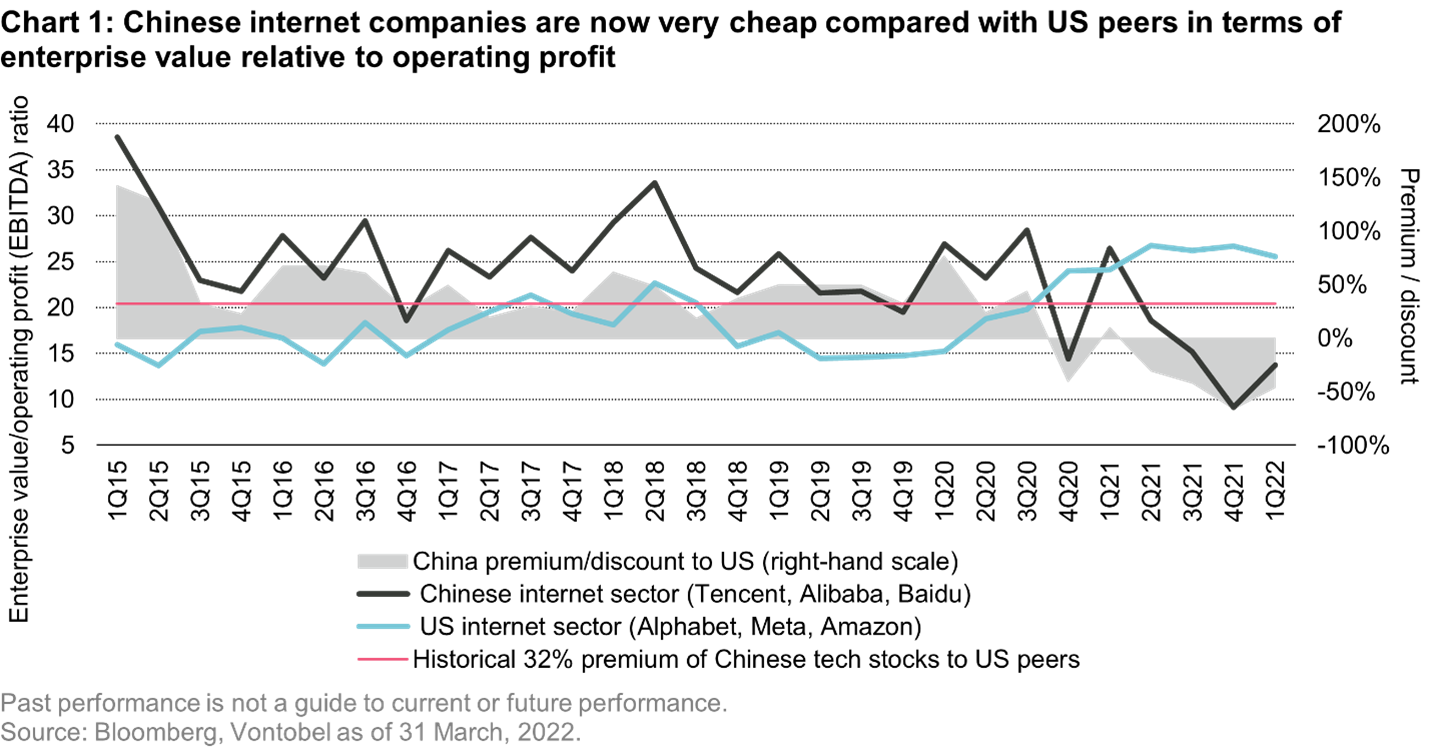

It’s worth noting that the large Asian internet companies were exceedingly expensive in early 2021, and this contributed to their underperformance last year. Looking at the three most established listed Chinese internet platforms Tencent, Alibaba, and Baidu, their combined valuation in terms of enterprise value/earnings before interest, taxes, depreciation and amortization (EV/EBITDA) went from 26.5x in the first quarter of 2021 to only 9.1x in the fourth quarter – a development associated with a statistical probability of less than 5%. The multiple has since improved a bit to 13.7x, but this still equals a discount of 46% versus the 25.5x of a representative US internet heavyweights basket of Alphabet, Meta, and Amazon. That compares to a historical 32% premium of Chinese internet stocks.

Regulators ease their grip, but uncertainty remains

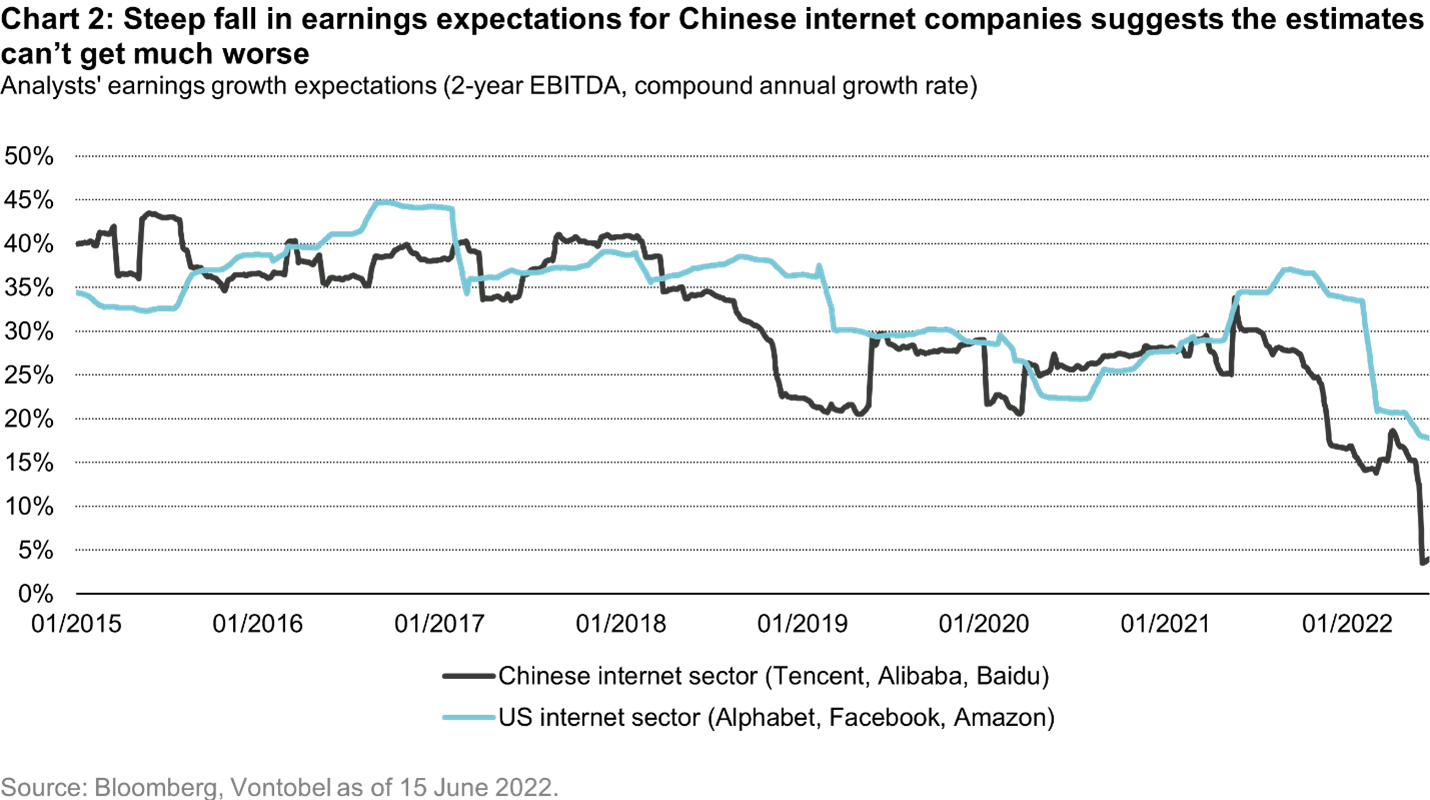

The Chinese leadership’s call on April 29 on regulators to support the internet platform economy has effectively put a floor under Chinese internet valuations, we believe. Other news also suggests that the regulatory tightening cycle is over, such as authorities reportedly wrapping up an investigation into ride-hailing company Didi Global. At what stage and to what degree valuations can recover remains to be seen. There is still a lot of uncertainty in the market. Moreover, Tencent executives have mentioned a “new industry paradigm” of lower and more sustainable growth. But considering current market expectations for Chinese internet platforms over the next two years, we think the companies could be able to beat analysts’ earnings growth estimates, which are at a low 4%.

We think economic conditions should eventually improve again, from what could be a disastrous 2022. Cloud computing and fintech still have large growth potential in China, and leading internet companies should be able to monetize games as well as user traffic on their platforms. Some green shoots like tentative reopening measures and better e-commerce in May have also emerged. Therefore, it looks as though valuation multiples have limited downside, and that analysts are hardly likely to reduce their earnings expectations much further. Thus, the gap to US peers could narrow again, especially if that segment starts feeling the pinch of mounting recession fears. Overall, we believe that able stock pickers could take advantage of long-term opportunities in Chinese internet names.

Australia

Australia China

China India

India Indonesia

Indonesia Japan

Japan Malaysia

Malaysia Philippines

Philippines Singapore

Singapore South Korea

South Korea Taiwan

Taiwan Thailand

Thailand Vietnam

Vietnam