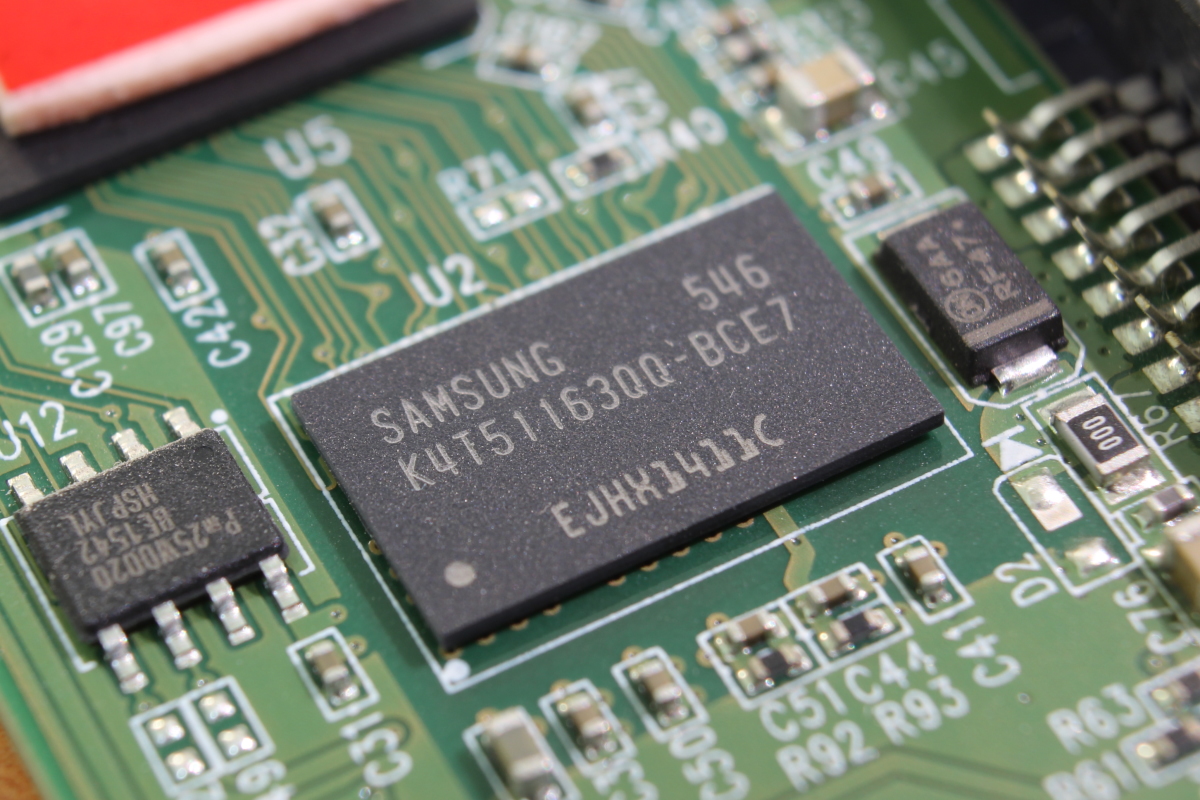

Samsung Electronics is planning to ramp up its semiconductor production. The South Korean conglomerate plans to more than triple its production of advanced semiconductors by 2027. The production goal announced in early October includes deploying 2 nanometres (nm) chips by 2025, and 1.4nm chips by 2027. In particular, Samsung wants to target high-performance and low-power semiconductor markets such as HPC, automotive, 5G and the Internet of Things (IoT).

The South Korean electronics giant’s aggressive five-year plan also aims to attract US chip buyers with a variety of more advanced semiconductors, including the 1.4 nm, as the company is looking to increase its revenue three-fold from the 2021 level. To achieve the dual targets – chip production and revenue -, Samsung will need to make significant technological leaps.

Samsung and TSMC rivalry heats up

Revenue-wise, Samsung is the largest chip manufacturer in the world but its foundry business is running behind that of Taiwan Semiconductor Manufacturing Co. (TSMC), which is the market leader in high-performance semiconductors. Both companies outbid each other in the battle for the most advanced semiconductors. TSMC also earlier this year announced the goal to produce 2 nm chips by 2025. In the race to mass-produce 3mn chips, Samsung started production this summer, the Taiwanese competitor just started in September. On the other hand, Samsung was left in the cold when TSMC won an order to manufacture the Nvidia RTX 40 series of graphics cards which uses 4mn chips.

On another note, Samsung plans to also extend chip manufacturing in the US. In August, US President Biden signed the CHIPS Act, a multi-billion dollar investment package that provides subsidies and tax incentives to bring semiconductor manufacturing back to the United States. Samsungs already has a production facility in Austin, Texas, and a new high-tech plant is under construction in nearby Taylor, investing $17 bn. The foundry in Taylor is scheduled to be operational in 2024.

According to local reports, Samsung could open as many as 11 chipmaking facilities in the Austin area over the next two decades. Filed documents with the state of Texas show that the move could lead to nearly $200 bn in new investment and create more than 10,000 jobs.

“US customers are especially interested in production in the United States, for supply chain stability,” Moonsoo Kang, executive vice president of Samsung Electronics foundry business, said. “Our Taylor site is very large … It’s a good site for expansion”.

Meanwhile, TSMC is also working to enhance its presence in the United States. Last year the Taiwanese company has pledged to spend $100 bn by 2024 on factory expansions.

TSMC has obtained a legal go-ahead to build a semiconductor plant in Phoenix, which involves spending up to $12 bn over the next decade. 5mn chip mass production is due to start at the site in 2024. “It is unlikely that TSMC will not expand capacity,” market analysis firm Isaiah Research in Taipei said in a statement. “Under the situation that semiconductor demand is clear in the future if TSMC does not expand capacity, the global chip supply will be very short.”

Australia

Australia China

China India

India Indonesia

Indonesia Japan

Japan Malaysia

Malaysia Philippines

Philippines Singapore

Singapore South Korea

South Korea Taiwan

Taiwan Thailand

Thailand Vietnam

Vietnam Germany

Germany Hong Kong

Hong Kong USA

USA Switzerland

Switzerland Singapore

Singapore

United Kingdom

United Kingdom