Asia braces itself for an election-heavy year as nine countries go to polls. With a combined population of 2.2bn and an aggregate nominal GDP of $8.9 tn in the countries where voting is due*, the Asian elections are quite significant, not only for the region but also on a global scale.

Given the tensions with China, the most crucial election coming up might be Taiwan’s presidential and legislative elections this weekend. Furthermore, speculation is rife that Japan and Singapore could also see a sudden change in their election timeline in 2024 and get a new leadership.

Here are the biggest Asian elections to watch out for.

January 13 – The elephant in the room: Taiwan elections

Taiwan’s mid-January polls might be the most crucial elections in Asia this year given the tense relations with China. Experts anticipate Lai Ching-te, the current Vice President and the candidate of the ruling Democratic Progressive Party (DPP) to win the election. This could lead to more volatile relations with China given the pro-independence stance of the candidate. On the other hand, the opposing parties, the Kuomintang, and Taiwan People’s Party believe in more dialogues with China.

An escalating conflict in the Taiwan Strait would be devastating for Asia, says Economist Intelligence (EIU). A model developed by the EIU sees a severe shock of the entire supply-chain network in Northeast and Southeast Asia. EIU doesn’t see any substitute for Taiwan in semiconductor supply chains, though South Korea could be an alternative over the long term.

“We believe fiscal policy is likely to remain relatively consistent whichever party wins power, with medium-term fiscal discipline anchored by Taiwan’s adherence to keeping public debt well below the 50% of GDP ceiling, as enshrined in the Public Debt Act,” says Fitch Ratings.

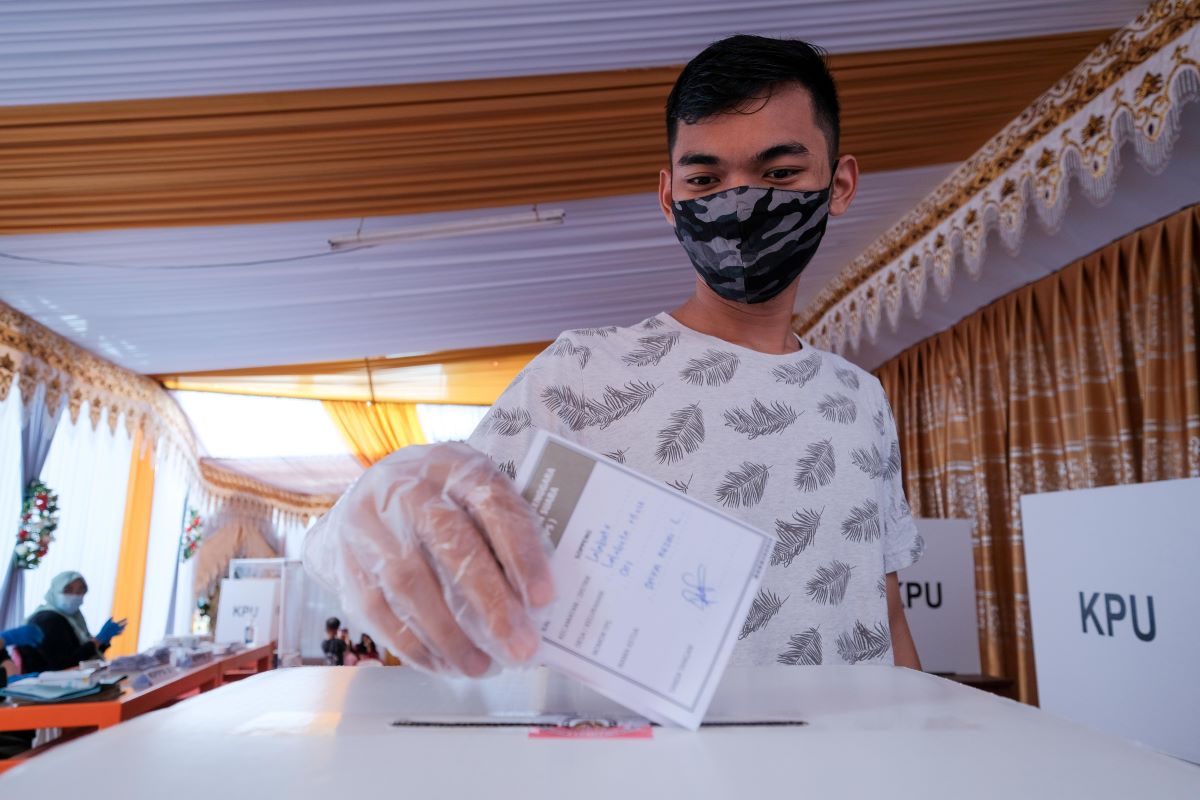

Febuary 14 – Jokowi 3.0 in Indonesia?

With the polls scheduled for February 14th, Indonesia may not see any candidate achieving a majority. However, political analysts see Defense Minister, Prabowo Subianto, the chairman of the Great Indonesia Movement Party (Gerindra) in the lead at the moment, with support from the current President, Joko Widodo (Jokowi) who will step down this year. Prabowo’s vice presidential nominee is Gibran Rakabuming, Jokowi’s eldest son.

One of the Prabowo-Gibran couple’s most important projects would be the continuation of Jokowi’s Nusantara Capital City project, which aims to relocate the seat of government from Jakarta to the new capital city currently under construction in East Kalimantan. Meanwhile, the opposing candidate, Anies Basweda has raised doubts on this project and highlighted that the country needs other infrastructure investments on priority.

In their election manifesto, Prabowo and Gibran have vowed the continuation of Jokowi’s downstreaming policy and infrastructure investment. Developing rural areas, building low-cost homes, and providing direct cash aid also feature in their manifesto.

DBS analysed the past four election cycles in Indonesia and concluded, “Average of the past four cycles point to a retreat in retail inflation in the run up and thereafter stabilise to rise in a quarter after the elections.”

April 10 – Neck-and-neck race in South Korea

The chances of President Yoon Suk Yeol and his People Power Party (PPP) in South Korea’s April elections seem mixed as he faces the liberal Democratic Party of Korea (DPK). According to latest polls from end of December, 35% of respondents remain undecided about which party candidate to vote for. 29% said they would vote for PPP, while 25% would support DPK.

However, if Yoon retains power, Oxford Economy stated, “….we suspect the main economic implication will be to keep the pace of fiscal consolidation gradual, as political friction will restrict Yoon’s ambitions to cut back the size of the state more drastically.”

Besides, President Yoon has pledged reforms in the pension system and an end to market monopolies. He has also planned a removal of capital gains tax on income from financial investments.

The country see a slow economic recovery and has just lowered its forecast for economic growth in 2024 from 2.4% to 2.2%.

April/May – Likely no change in India

For India, no change in leadership is expected as the Bharatiya Janata Party (BJP) led coalition appears set for the third term. The high approval rating of Prime Minister, Narendra Modi, previous reform initiatives, and India’s apparent gain in global positioning is likely to favour the upcoming elections in April-May 2024.

However, EIU opines, “We do not expect any ‘big bang’ reforms under a returning BJP administration led by Mr. Modi, which will continue to focus on issues such as land acquisition, labour market initiatives, and agriculture reforms.” They added that existing initiatives in the manufacturing, infrastructure, and defence sectors would also continue.

September – Japan’s LDP election could lead to market volatility

This year, Japanese Prime Minister, Fumio Kishida from the ruling Liberal Democratic Party (LDP) is likely to face a political fallout amid the fundraising scandal. The law demands parties to report revenue from political fundraisers if any individual or company purchases tickets worth over $1,375 in a year. However, reports indicate that five major LDP factions, including the Kishida faction, made nearly $275,000 from ticket sales that were not reported lawfully since 2021.

Kishida’s current term as LDP president would end in September 2024, however, he could be forced to step down earlier. The four-year terms of current lower house members are set to expire in October 2025 unless the chamber is dissolved by the prime minister.

The Kishida administration has seen major public anger due to its inability to end the negative spiral of subsidy dependence since the pandemic in 2020.

Frequent change in leadership is not new in Japan. On that note, Sumitomo Mitsui DS Asset Management stated, “Although 2024 will be politically windless due to the absence of major national elections, there is a risk of rising market volatility impacted by the political situation due to the LDP’s leadership election in September 2024.”

End of 2024 – Sri Lanka, Pakistan to stay politically and economically unstable

Meanwhile, Pakistan and Sri Lanka, both of which are expected to go to the polls this year, are facing major economic woes and are under the IMF programmes for stability fiscal, and economic consolidation.

Fitch Ratings is apprehensive about the escalating financial challenges of both countries and their high political volatility. “There is still a risk that Sri Lanka’s IMF programme goes off track, or that Pakistan’s incoming administration fails to smoothly secure a successor programme to its current short-term IMF financing arrangement,” cautions Fitch.

* Bangladesh, India, Indonesia, Maldives, Mongolia, Pakistan, South Korea, Sri Lanka, Taiwan as per Economist Intelligence Unit Asia Elections Monitor 2024

Australia

Australia China

China India

India Indonesia

Indonesia Japan

Japan Malaysia

Malaysia Philippines

Philippines Singapore

Singapore South Korea

South Korea Taiwan

Taiwan Thailand

Thailand Vietnam

Vietnam Germany

Germany Hong Kong

Hong Kong USA

USA Switzerland

Switzerland Singapore

Singapore

United Kingdom

United Kingdom