There is a growing focus on investing sustainably within Asian credit, writes Dhiraj Bajaj, Head of Asian Credit at Lombard Odier Investment Managers, in this guest commentary.

Despite the slowdown owing to the pandemic in 2020-2021, Asia continues to act as the global growth engine. It is estimated the region will contribute more than 50% of global GDP based on purchasing power parity by the end of 2040, as well as accounting for around 40% of the world’s consumption, according to the Asian Development Bank. However, various bottlenecks must be overcome to realise the full economic potential of the region. These include strained infrastructure, housing shortages and deteriorating urban services across many countries.

Estimates by the UN’s Economic and Social Commission for Asia and the Pacific suggest significant funding gaps to meet key sustainable development goals will remain across Asia Pacific until 2030. There is therefore a need for investment across regions and sectors to address these structural issues. At the same time, the global investor community is increasingly aware of environmental, social and governance (ESG) factors and focused on transparency regarding ESG-related matters. This has led to the rise of bonds being issued subject to ESG criteria.

We expect ESG-related bonds to make up an increasing proportion of the investable credit universe in Asia going forward, as investor preferences adjust to reflect growing global commitments on environmental goals.

ESG bonds – not a new phenomenon within Asian credit

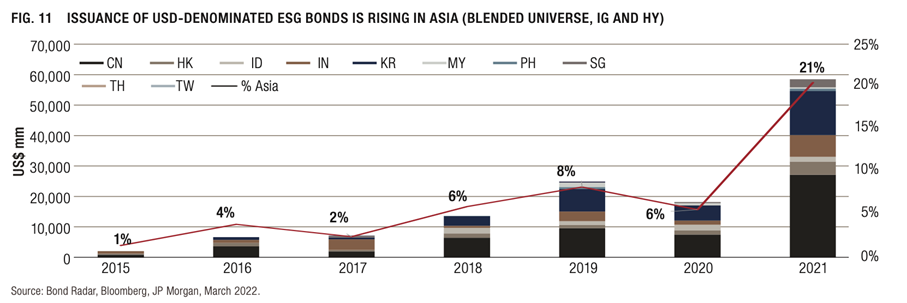

ESG bonds are not a new phenomenon within the Asian credit universe; we have seen bonds classified under ESG criteria since 2013, in the form of a 500 m USD five-year bond issue by the Export-Import Bank of Korea. Since 2018, however, issuance has picked up sharply, with China and India leading the way.

ESG bonds make up an increasing proportion of the Asian market, with 10% of gross issuance in the region classified under ESG criteria, as per JP Morgan (March 2021). Within the wider EM credit universe, Asian issuers are ahead of the curve in terms of this trend.

China accounts for the largest proportion of ESG bonds within Asia by country, with close to 40% of issuance between 2013 and 2021. It is followed by Korea and India. In terms of sectors, financials are dominant for ESG bond issuance across the region. In China, ESG bonds are issued by banks, lessors and industrial SOE (state-owned) firms to support green infrastructure development. Meanwhile, in India the renewable energy sector dominates green bond issuance, although companies in the USD hard currency market are largely sub-investment grade. Elsewhere, in Korea utilities have been the key issuers of ESG bonds, along with industrials.

Transition towards carbon neutrality

On a sovereign level, major countries across Asia have already committed to carbon neutrality targets. For example, China has pledged to achieve net-zero status by 2060 and aims to reach peak carbon emissions before 2030; Japan has committed to achieving net-zero by 2050 and has implemented emission reduction targets of 46% below 2013 levels by 2030; and India has vowed to reduce emissions intensity by 33-35% by 2050 and to reach net-zero emissions by 2070.

As investors assess how companies in their portfolios are transitioning to a net-zero future, the issuance and diversity of ESG bonds continues on a strong upward trend. Companies are adapting to investor demand with frameworks and transition plans towards carbon reduction, and we have seen a wide range of initiatives across sectors as well as countries at a corporate level across the region.

Dhiraj Bajaj

Head of Asian Credit

Lombard Odier Investment Managers

Dhiraj Bajaj is a portfolio manager and Head of Asian Credit at Lombard Odier Investment Managers, based in Singapore. Previously, he was a Credit PM at Cairn Capital in London, a full-service credit AM firm, from 2006 to 2012. In 2006, he worked at JPM in credit and rates research in London. He started his career at Singapore Airlines (2000-2005) in corporate strategy. Bajaj holds a Bachelor of Engineering (with honors) in Mech Engineering with a minor in Economics from the National University of Singapore and a Master of Business Administration from the University of Cambridge.

Australia

Australia China

China India

India Indonesia

Indonesia Japan

Japan Malaysia

Malaysia Philippines

Philippines Singapore

Singapore South Korea

South Korea Taiwan

Taiwan Thailand

Thailand Vietnam

Vietnam Germany

Germany Hong Kong

Hong Kong USA

USA Switzerland

Switzerland Singapore

Singapore

United Kingdom

United Kingdom