The growing chorus for climate change initiatives has brought the focus on ESG investing, and Asia is at the centre of the discussion. The region is expected to be among the worst affected due to global warming which is why Asia sustainability investments could be a key to reducing the environmental, economic as well as social damage.

The International Monetary Fund (IMF) in a report highlighting the perils of climate change in Asia, says that the region is experiencing rising temperatures nearly two times faster than the global average. This has caused various natural disasters in Asia.

Why focus on Asia sustainability investments?

In 2021, there were over 100 natural disasters in Asia, as per the UN’s World Meteorological Organization. Compared to the past two decades, economic damage due to droughts rose 63%, due to floods it increased 23% and due to landslides, it increased 147%.

The WMO report also states that the total economic damage in 2021 amounted to $35.6 bn.

“Given that floods and tropical cyclones in the region account for the highest economic losses, investment in adaptation must be directed towards prioritizing anticipatory action and preparedness,” said Armida Salsiah Alisjahbana UN Under-Secretary-General and Executive Secretary of ESCAP (Economic and Social Commission for Asia and the Pacific).

While Asia seems to be facing the brunt of the pollution by some of the world’s developed economies, as stated during the COP27 where climate justice discussion, the region is a major polluter as well.

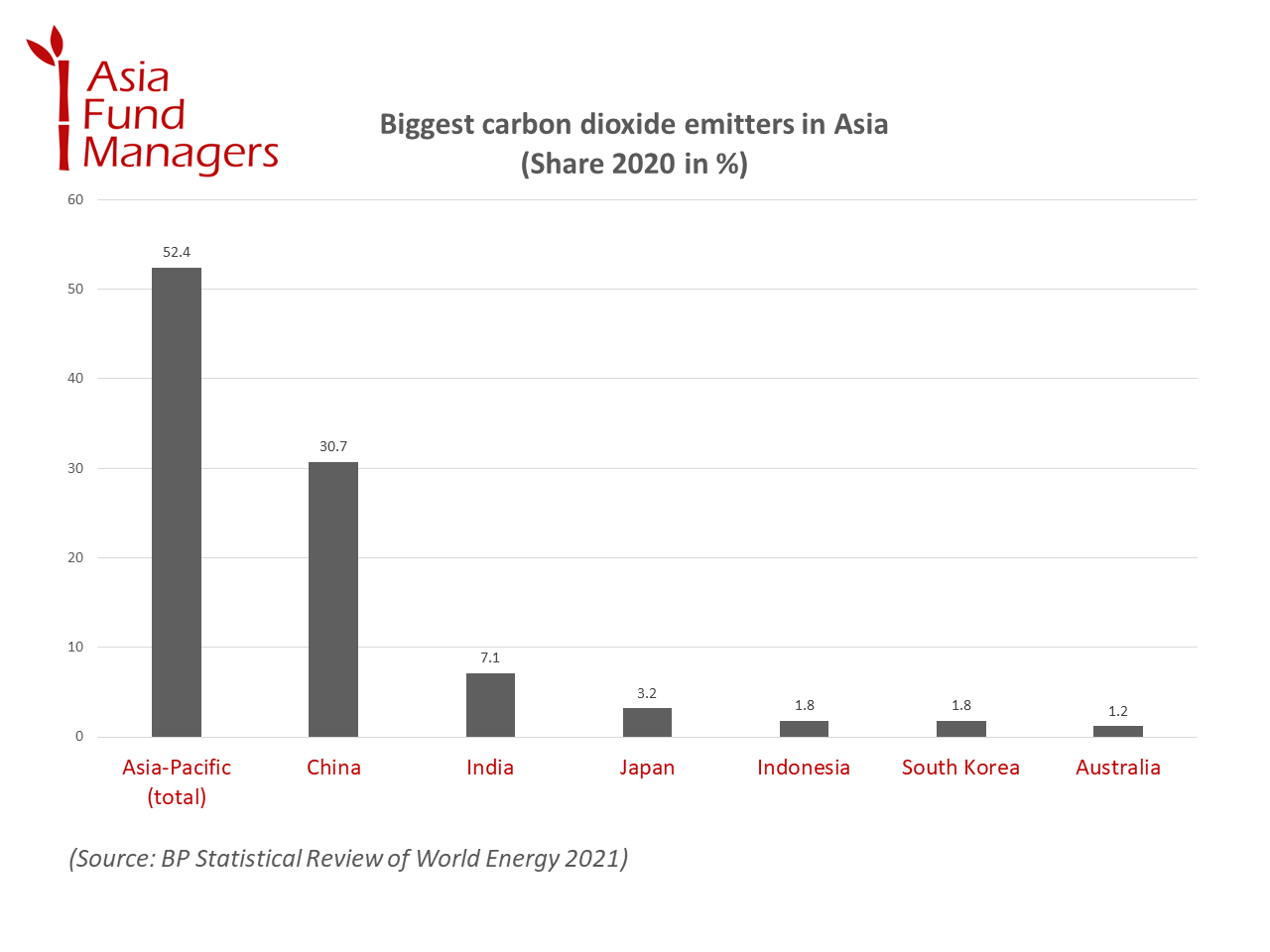

Energy giant BP’s 2021 Statistical Review of World Energy showed that the Asia-Pacific region was responsible for 52% of the world’s carbon dioxide emissions. China alone contributed 59% to the region’s carbon footprint while India was responsible for 13.7%.

On the other hand, IMF says that the Asia Pacific region is more prone to severe weather-related disasters compared to the rest of the world. “In view of Asia’s substantial share of current emissions as well as its expected future emissions growth, China, India, and other large CO2-emitting countries’ policies to curb emissions will be a critical element of the global effort,” says the IMF.

The question is where does this high carbon footprint come from? Asia’s coal-based power generation, manufacturing industries such as steel and motor vehicles, agricultural activities and transportation are among the reasons for the high levels of pollution, as per a 2020 McKinsey report.

“By 2050, parts of Asia may see increasing average temperatures, lethal heat waves, extreme precipitation events, severe hurricanes, drought, and changes in water supply, based on RCP 8.5*,” says McKinsey.

Status of Asia sustainability investments

As of August 2022, 39 out of 49 Asia-Pacific member states had made carbon neutrality and net-zero pledges, says the UNESCAP. A report by the UN agency found while of the 39 countries, several had advanced in developing national laws, strategies and implementation plans in line with Nationally Determined Contribution (NDC) commitments. However, national development plans are not sufficiently aligned with these NDC and carbon neutrality pledges.

Let us take a look at some of the key initiatives in Asian economies in comparison to the Paris Agreement.

Asia’s largest economy and top polluter, China, has said it would peak its carbon emissions in 2030 and head for carbon neutrality by 2060. The country has been trying to reduce the usage of coal, but China is still highly dependent on fossil fuel for electricity production.

Beijing has been pushing for new energy vehicles (NEVs) such as electric cars and hydrogen fuel cell cars and has provided subsidies to several EV and battery makers. China is now a leader in EV and EV battery manufacturing, with BYD surpassing Tesla in sales to become the top EV maker.

The country is also seeing rising investments in renewable energy and it has one the highest amount of wind and solar capacity. China also produces nearly 80% of all solar panels in the world, and with demand set to rise certain companies are expected to benefit massively.

India, the third largest greenhouse gas emitter in the world, has pledged to reach net-zero emissions by 2070. This is much farther than most of the other countries in the region. The country wants to meet 50% of its power generation needs by using clean sources of fuel, however, India plans to use coal until at least 2040.

In fact, India is trying to increase its coal output by 50% and previously shut mines have been instructed to restart operations. However, the country is also trying to add renewables to the mix, with 2022 seeing the highest growth in renewable energy additions of 9.83%.

Investments in renewable energy in India hit record levels during the financial year 2021-22, as per the World Economic Forum. Nearly $15.4 bn was invested in renewable energy, a 125% jump over the previous year, and up 72% compared to the pre-pandemic period of the 2019-2020 financial year.

In the ASEAN region, of the 10 countries eight have announced targets to become carbon neutral by 2050. Indonesia has set a net-zero target of 2060, while the Philippines is yet to make any such commitment.

“The region’s total emission will move downward only from 2041, owing to accelerated renewable growth combined with a phase-down of coal in total power generation. The reduction will accelerate from 2045 owing to the implementation of multiple decarbonization measures in the region, including large-scale coal capacity retirement and the expectation of carbon capture and storage (CCS) technologies being installed largely on new thermal power plants,” S&P Global said in a report.

Elsewhere, Japan is aiming to reduce 46% of emissions by 2030 compared to 2013 levels. The country is targeting to go net-zero emissions by 2050.

South Korea has a similar ambition to go net-zero by mid-century. “Several South Korean companies are leading players in various green technology markets including the growing rechargeable battery sector. In September 2021, South Korean manufacturers had a 33.8% share of the global market in rechargeable batteries, led by firms like LG Energy Solution (23.8%), SK Innovation (now referred to as SK On) (5.4%), and Samsung SDI (4.6%), making the country one of the most promising hubs in this global supply chain,” writes Carnegie Endowment for International Peace.

Taiwan, a major manufacturer of semiconductors and other electronic peripherals, recently introduced a climate change law under which it is targeting net-zero carbon emissions by 2050. The country also plans to eliminate the use of nuclear power by 2025, in light of the Fukushima disaster of 2011.

Gaps in achieving net-zero targets

“Global ESG AUM is forecasted to triple between 2020 and 2025 to $6.5 tn USD. Of which, Asia is expected to be a key driver of growth, with ESG AUM forecasted to quintuple from $90 bn in 2021Q3 to more than $500 bn by 2025,” says Invesco.

Asia sustainability investments are key in such a scenario, but ESG investing in Asia has lagged compared to other regions. Asia is a diverse region with different policies and reporting standards, which makes it difficult for investors to pick assets. Additionally, several taxonomies in Asia are only voluntary disclosures.

“Investors should keep an eye out for developments in the fast-transitioning Asian ESG scene. Already, Asia leads the global energy transition with China alone accounting for 35.2% of energy transition investment in 2021,” adds Invesco.

The 2022 macroeconomic crisis around the globe hit green bond issuances as well, with Asia seeing a drop by 2.5% to raise $120.83 bn through green bonds. However, this is still better than the 32.5% drop seen in Europe and the 43.2% fall in North America.

Asia sustainability investments – opportunities

Considering the wide impact of climate change and the importance of Asia in achieving goals set under the Paris Agreement, Asia sustainable investments could be opportune. Here are some of the funds and ETFs that are currently investing in Asia’s sustainability story.

Eastspring Investments – Asia Sustainable Bond Fund

The Asia Sustainable Bond Fund (LU2068974737) by Eastspring was launched in December 2019 and comes with an initial charge of a maximum of 3% and annual management fees of a maximum of 1%.

The fund invests at least 70% of its assets in debt securities denominated in USD, Euro, and various Asian currencies, issued or guaranteed by Asian governments and corporates. Eastspring uses its in-house ESG principles and Green to choose the bonds to invest in.

As of February 28, 2023, the fund had assets under management of $206 m. Since its inception, the fund has seen a cumulative loss of 1.3% p.a. (bid-bid; offer-bid 2.3% p.a.).

The top five holdings of the fund are the JP Morgan Liquidity Funds – US Dollar Liquidity Fund (4.8%), Mapletree Treasury Services Ltd 3.58% with maturity date 13-March-2029 (2.4%), Keppel Corporation LTD 2.9% with maturity date 31-December-2079 (2.3%), Kyobo Life Insurance CO LTD 5.9% with maturity date 15-June-2052 (2.1%) and Korea Development Bank 4.375% maturity 15-Feburary-2033 (1.8%).

Sector-wise, the fund is mostly invested in bonds from banking (20.1%) followed by other REIT (9.7%), foreign agencies (9.5%), life insurance (7.9%) and other financial institutions (7.0%).

The fund has the highest exposure to Singapore (25.3%), followed by China (15.8%), South Korea (11.8%) Hong Kong (7.7%) and Australia (6.2%).

When we look at the maturity of the bonds the fund is investing in, the highest allocation was for maturity between 1-3 years at 29.8% and 3-5 years at 25.9%.

Fidelity Funds – Sustainable Asian Bond Fund

Launched in late 2021, the Sustainable Asian Bond Fund (LU2386145036) by Fidelity invests in fixed-income securities issued by governments, quasi-governments and corporates which have business activities in Asia. The fund is targeting to have a lower carbon footprint compared to the J.P. Morgan Asia Credit Index. Assets under management stood at $18 m (as of February 28, 2023).

The fund has an annual ongoing charge of 1.44%. As of February 28, 2023, the fund has seen cumulative losses of 12.0% since inception. However, it also has a distribution yield of 3.1%.

The fund has 98.9% exposure to USD-denominated bonds. The top holdings include Airport Authority Hong Kong, 2.1% perp. (3.62%), SK Hynix Inc 2.375% with maturity date January 2031 RGS (3.09%), OCBC L 1.832%/VAR with maturity date October 9, 2030, RGS (2.84%), Bangkok Bank Pcl/Hk (2.62%) and Philippine Govt 5% with maturity date August 17, 2033, (2.38%).

Sector-wise, the fund has the highest exposure to banks and brokers (33.45%), followed by Quasi / Sov / Supra / Agncy (16.99%, comparable to bonds issued by European Investment Bank), and Technology (13.69%).

The fund is largely invested in Asia ex Japan ex Australia (80.83%), followed by Japan (7.45%), and Australia & NZ (4.80%).

MSCI has an ESG Fund Rating of AA for Fidelity’s Sustainable Asian Bond Fund.

HSBC Asia Pacific ex Japan Sustainable Equity ETF

The Asia Pacific ex-Japan Sustainable Equity ETF (IE00BKY58G26) was listed on the London Stock Exchange in August 2020. The ETF tracks the 100% FTSE Asia Pacific ex-Japan ESG Low Carbon Select Index.

Since its inception, the fund has given 4.49% returns (as of January 31, 2023). The ongoing charge figure for the ETF is 0.250%.

As of January 31, 2023, the top holdings of the ETF are TSMC (8.18%), BHP Group (6.31%), Samsung Electronics (5.94%), Infosys Ltd (5.09%), and Ping An (4.28%).

The biggest exposure of the HSBC ETF sector-wise are financials (27.14%), technology (26.45%), basic materials (13.48%), consumer discretionary (8.5%) and consumer staples (4.84%).

With 29.77% the ETF is mainly invested in mainland China, followed by Australia (17.73%), India (12.94%), Taiwan (12.55%) and South Korea (10.55%).

*global warming scenario

Australia

Australia China

China India

India Indonesia

Indonesia Japan

Japan Malaysia

Malaysia Philippines

Philippines Singapore

Singapore South Korea

South Korea Taiwan

Taiwan Thailand

Thailand Vietnam

Vietnam Germany

Germany Hong Kong

Hong Kong USA

USA Switzerland

Switzerland Singapore

Singapore

United Kingdom

United Kingdom