Persistent economic headwinds in global financial markets have advanced bears, but bulls are also eyeing the tiniest ray of hope for a rally. A similar situation was seen in Asian stocks in November, as investor sentiment sweetened from China’s easing of Covid-19 restrictions and dovish statements from US Federal Reserve chair Jerome Powell.

On November 30, Powell in a written speech said the US Federal Reserves is likely to reduce the magnitude of rate hikes as early as December but asserted that the scaling down does not mean the Fed’s fight with inflation is over.

Asian stocks get a boost

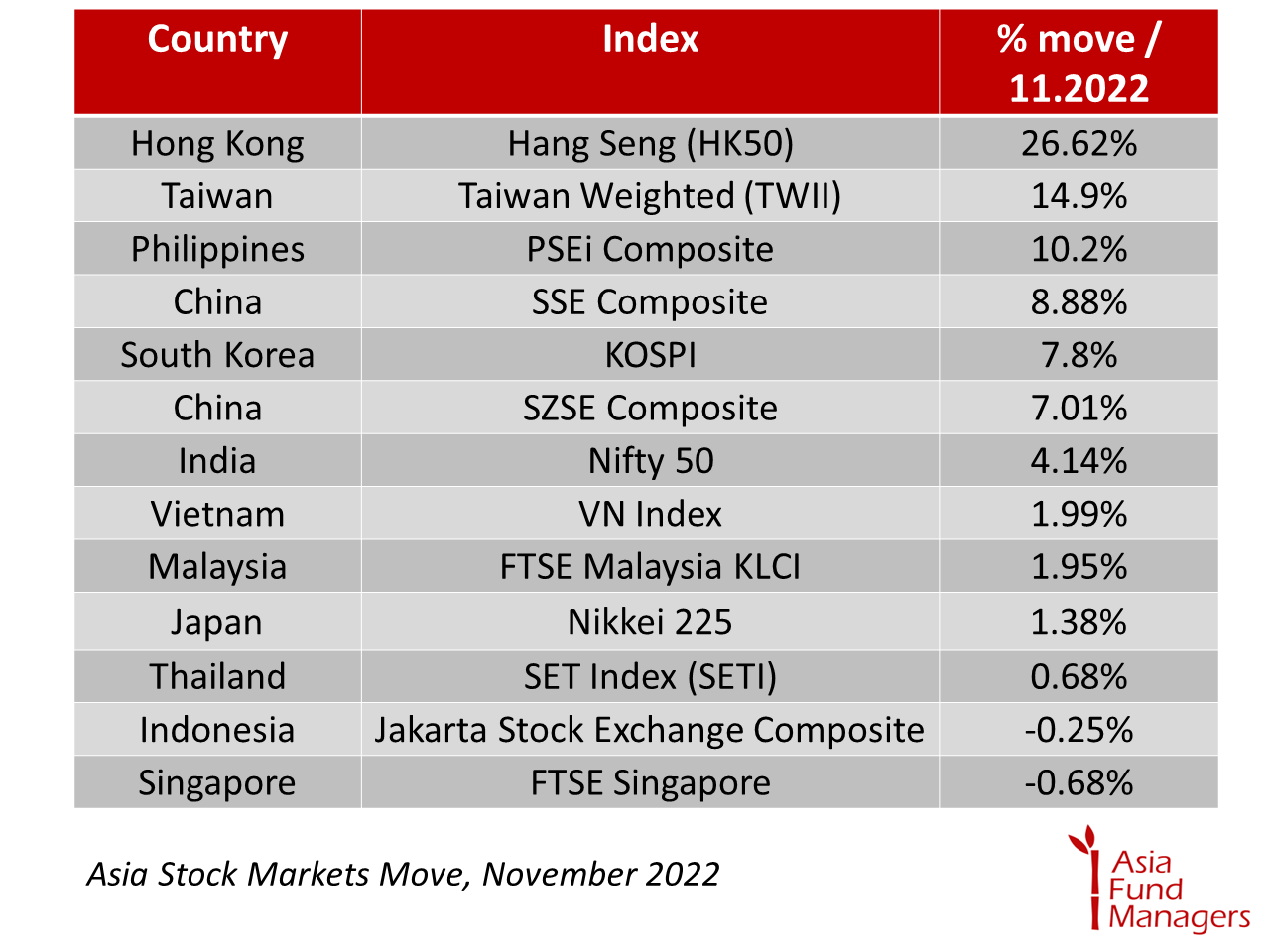

Equities in Asia have taken a beating in 2022, but there are certain countries which have been outperformers, such as India. Asian stocks had the best November since 1993 compared to other global markets.

“Any positive catalysts such as a potential China re-opening and policy support, lowering of geopolitical tensions or tech cycle bottoming is likely to drive a sharp rerating,” Jefferies strategists led by Desh Peramunetilleke wrote in a note.

The MSCI World Index, which tracks large and mid-cap firms across 23 developed market countries, added nearly 7% in the month of November, whereas the MSCI AC Asia Pacific Index gained about 15% during the month.

Asian stocks did well during November largely due to the gains posted by Taiwan, the Philippines and Hong Kong’s benchmark indices.

Taiwan stock markets attracted the highest foreign capital in the region as investors are betting on the semiconductor sector making a comeback by mid-2023. The recent meeting between Chinese President Xi Jinping and US President Joe Biden eased geopolitical worries, while the easing of Covid restrictions in China aids the case of supply chains. China is the biggest trading partner of Taiwan.

The Taiwan Weighted Index rose nearly 15% in November, led by the gains posted by blue-chip stock Taiwan Semiconductor Manufacturing Co (TSMC), which jumped 25.64%. One of the largest investments in the country came from Warren Buffet’s Berkshire Hathaway, which picked up a stake worth $5 bn in TSMC.

Overall, Taiwan saw foreign inflows of nearly $6 bn in the month of November, nearly half of the total foreign inflows in Asia, as per Bloomberg.

The Philippines Stock Exchange PSEi Index was another great performer in the region with gains of over 10% in November. The dovish stance of the US Federal Reserve and positive regional indicators helped the stock market in the country.

The Hang Seng Index in Hong Kong was the best performing in the region, largely due to the change in the stance of China over zero-Covid. However, the steep declines seen in Hong Kong during the year have also made stock valuations attractive.

“The Hong Kong SAR market also offers considerable value and strong businesses that can ride out the current downturn. Financial companies in Hong Kong SAR, Singapore, and parts of Southeast Asia will also be beneficiaries of higher interest rates and offer attractive valuations and yields,” says Schroders in its 2023 Outlook.

The Hang Seng Index’s over 25% jump during November is the best since 2003 and was led by investors piling into technology in real estate stocks. China’s regulatory crackdown on the technology sector has neared its end, while the real estate sector got a lease of life from the 16-point plan and eased deleveraging pressure.

Indices in the mainland, the SZSE Composite and SSE Composite indices, were up more than 7% each. Apart from easing restrictions, China is also boosting vaccinations and investors are banking on the Covid-19 policy pivot.

“Any sign that China is willing to relax its dynamic zero-Covid policy is likely to be received very positively by the market given the potential boost to earnings and valuation multiples following the terrible performances seen in the past 18 months,” writes Toby Hudson, Head of Asian ex-Japan Equity Investments at Schroders.

Outlook for Asian stocks

Asian equity markets have not been immune to global macro headwinds, including rising interest rates, a strengthening US dollar and lingering recession risks. Geopolitics remain in focus as the Russia-Ukraine conflict and US-China tensions add to uncertainty,” writes William Lam, Co-head of Asian and Emerging Market Equity at Invesco.

“However, domestic macroeconomic conditions in Asia should continue to remain largely stable in 2023, with inflation at more comfortable levels than in the US and Europe. Many countries in the region are at an earlier stage in their economic cycle, with rising incomes and consumer penetration a tailwind to structural demand.”

Previously, Goldman Sachs said it was bullish on China and South Korea, expecting the markets to outperform in 2023. Societe Generale SA has said it is bullish on Taiwan’s tech sector going into 2023.

Invesco is positive about Japan stocks, and said, “there’s a chance that Japan could achieve its multi-decade goal – sustained reflation and economic growth – in our opinion.”

Meanwhile, China looks like it may rebound in 2023 given the easing measures. “We believe the Chinese A-share market offers ample opportunities for value seekers, as valuations have fallen significantly for high-quality companies that are expected to bounce back quickly once controls ease. In addition, we expect continued policy support, though calibrated to avoid creating the bubbles of the past,” writes Elizabeth Soon, head of Asia ex-Japan Equities at PineBridge Investments.

Australia

Australia China

China India

India Indonesia

Indonesia Japan

Japan Malaysia

Malaysia Philippines

Philippines Singapore

Singapore South Korea

South Korea Taiwan

Taiwan Thailand

Thailand Vietnam

Vietnam

Germany

Germany Hong Kong

Hong Kong USA

USA Switzerland

Switzerland Singapore

Singapore United Kingdom

United Kingdom