South Korea, Asia’s fourth-largest economy, is largely dependent on exports and is the world’s leading producer of displays and memory semiconductors as well as the second-largest producer of ships. In recent years the country has also made headlines worldwide with another export hit, its musical culture K-pop, which has a huge economic impact on the country.

South Korea’s K-pop culture and music industry have become increasingly popular and thus have allowed the propagation of the music genre to many foreign nations through the Korean wave, also known as Hallyu. The K-Pop industry generates about $10 bn for the country each year, according to estimates.

The K-pop phenomenom is worldwide, with some of the major markets being the United States, India, Brazil, Indonesia, Mexico, Germany, UK, Philippines, Japan, and France. In 2021, Spotify unveiled its global K-Pop hub and the monthly average K-Pop streams worldwide reached over 7.97 billion per month. The same year, #KpopTwitter broke its own record with 7.8 bn global Tweets, the previous record being 6.7 bn Tweets in 2020.

K-Pop and the economic impact on South Korea

With Hallyu as a truly global phenomenon, it resulted in a broader interest in Korea – from tourism to study of the Korean language to interest in Korean fashion, and food.

Hallyu exports – e.g., from games to music and broadcast -, have a tremendous impact on South Korea’s economy. In 2004, it contributed 0.2% of the gross domestic product (GDP) – approximately $1.87 bn. In 2018, numbers were up to $9.48 bn and 2019 Hallyu had an estimated $12.3 bn boost on the Korean economy.

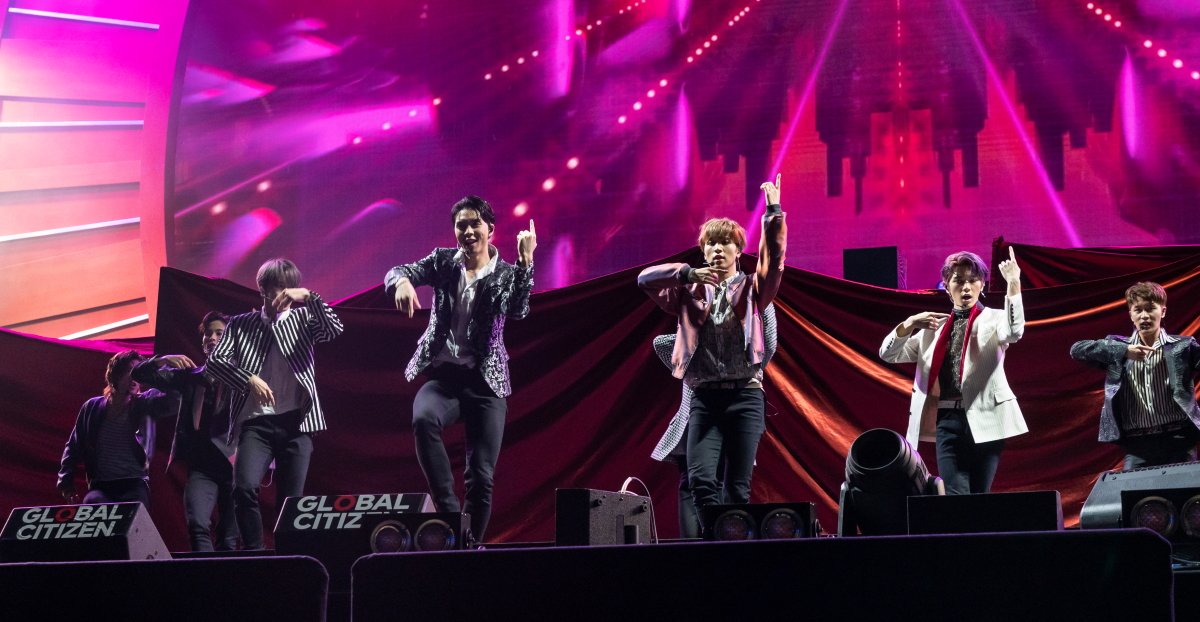

When it comes to the music, especially one K-pop group is at the forefront of the Hallyu wave. BTS, a seven-member boy band, is bringing in an estimated $5 bn to South Korea each year. And the numbers is rising.

BTS’ single ‘Dynamite’, the group’s first all-English song launched in 2020, peaked at number one on the Billboard Global Chart and stayed on the chart for 18 weeks. This song alone generated a stunning $1.43 bn in economic activity and about 8.000 new jobs, according to a study by the Ministry of Culture, Sports and Tourism and the Korea Culture & Tourism board.

The group’s three live concerts in Seoul in March 2022 have attracted 2.46 m fans both online and offline. The shows drew a total audience of 45,000 at Seoul Olympic Stadium for the three days and were also watched live by 1,020,000 and 1.4 million fans, respectively, online and at theatres. According to US magazine Variety, the live-streamed concert in theatres on March 13 brought $32.6 m in ticket sales at global box office.

BTS’ huge success has made them ambassadors for various brands, from cars to food to cosmetics – among them names like Samsung, McDonald’s, Puma or Louis Vuitton.

No end to the Hallyu wave in sight

A study by the Korean Foundation has shown that the direct economic impact of Hallyu has doubled from 2016 to 2019 and remains consistently on the rise and so has the indirect value – exports of consumer goods and tourism.

And export hit BTS is expected to bring in even more money now that the pandemic takes a back seat. If the group performs 10 times a year in South Korea, this could bring $9.9 bn to the country, a study by the Korea Culture and Tourism Institute in February 2022 found.

“If BTS normally holds a concert in Korea during the post-coronavirus period, the economic ripple effect will reach 677.6 bn KRW ($550 m) to 1.22 tn KRW ($989 m) for one performance,” the research team writes. “This analysis took BTS concerts as an example, but it shows that holding K-Pop concerts can have a huge impact on our economy.“

Australia

Australia China

China India

India Indonesia

Indonesia Japan

Japan Malaysia

Malaysia Philippines

Philippines Singapore

Singapore South Korea

South Korea Taiwan

Taiwan Thailand

Thailand Vietnam

Vietnam

Germany

Germany Hong Kong

Hong Kong USA

USA Switzerland

Switzerland Singapore

Singapore

United Kingdom

United Kingdom Other / International

Other / International