China’s economy faced a setback as its GDP grew at a rate of 6.3% between April and June 2023, falling short of the anticipated 7.1%. This lacklustre growth rate has raised concerns and set off alarm bells among policymakers who are grappling with the country’s post-Covid challenges.

While no stimulus package has been announced yet, China has made several moves to boost its economy. These measures include tax exemptions and credit extensions to boost business and consumption. The policymakers have slashed policy rates just once and are primarily focusing on targeted measures to boost.

Several sectors in China’s economy are now reliant on financial support for their revival. Here are some of the sectors poised to benefit from China’s policy for financial assistance.

Electric Vehicles

In June 2023, China extended tax breaks on new energy vehicles (NEV) until the next four years. The tax break will now be extended until 2027 from 2023. Under the extended policy, NEV vehicles purchased in China between January 1, 2024, and December 31, 2025, are eligible for a purchase tax exemption of 30000 yuan ($4,170) per vehicle.

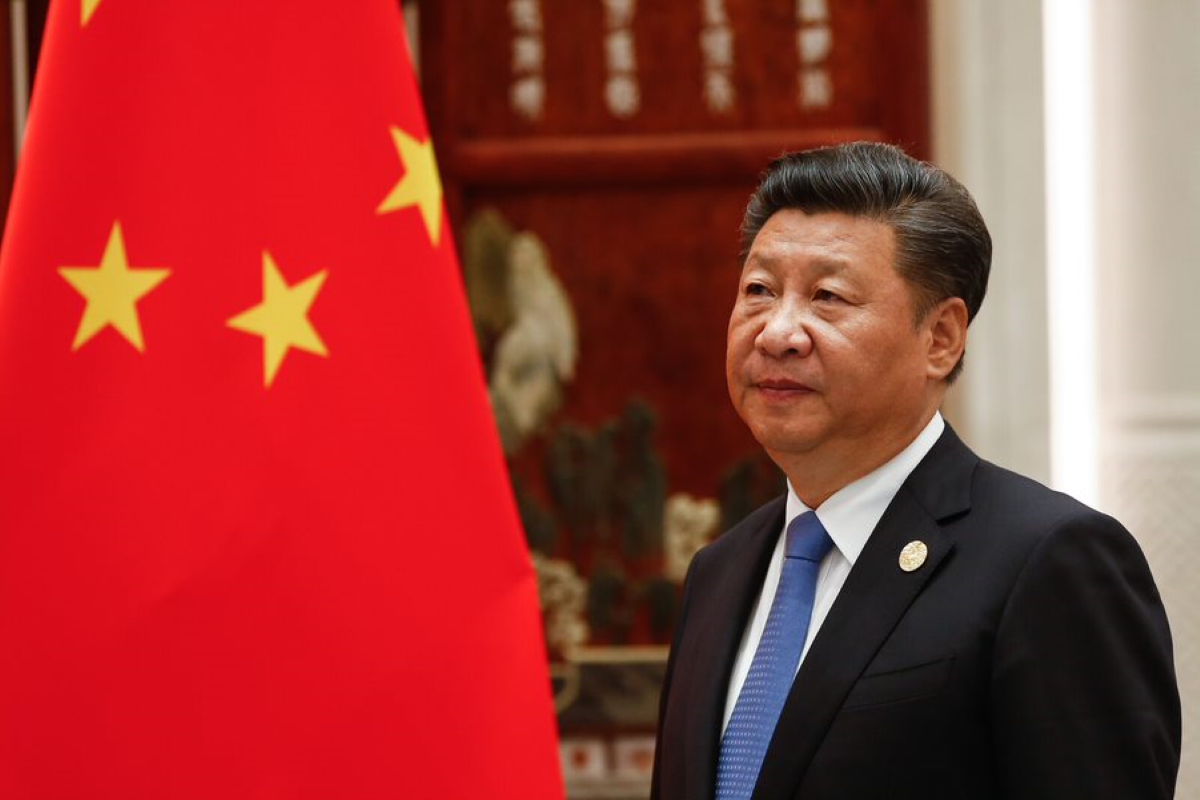

However, from January 1, 2026, to December 31, 2027, the per-unit exemption amount will be halved to 15,000 yuan ($2,078), indicating a gradual withdrawal of support by the Xi Jinping government. This move is aimed to boost domestic sales and maintain the country’s leading position in the global EV market. The extension also gives stability to consumers and manufacturers.

China also wants to boost foreign investment in electric mobility through such measures. The overall economic slowdown in China has dented the growth of the electric vehicle sector, where China has a dominant global position. However, even as the vehicle purchase tax exemption policy for NEVs is extended, there is no talk of a renewal of cash subsidies for EVs.

Private Sector

China acknowledges that the key to economic recovery is a robust private sector. Hence, it is leaving no stone unturned to create a conducive environment for entrepreneurship and back private enterprises.

The core problems faced by the private sector are the lack of capital and slowing business confidence. On July 18, Beijing unveiled a 31-point action plan that aims to boost job growth, technological advancements, and the overall growth of China’s economy.

The country’s government vows to abolish market-entry barriers and make business more accessible. The action plan also pledged to make the current mechanism to prevent payment defaults, which is important for small businesses. The 31-point action plan also aims to ensure a fair legal environment for private entrepreneurs and protects their legitimate interests and rights.

Real Estate

The People Bank of China (PBOC) on July 10 announced loan relief for developers to ensure the delivery of under-construction properties. There are also hints that PBOC would allow lenders to renegotiate mortgage contracts or issue fresh loans to reduce home loan financing costs.

On July 27, China’s housing minister called upon financial regulators and lenders to ease financing norms to strengthen the sector. He called for homebuyers who had paid off previous mortgages to be seen as first-time purchasers. A few days before that, the government announced its plans to boost the renovation of so-called urban villages.

Consumption Spending

China’s economy is heavily driven by consumption spending. On July 18, Beijing announced a plan to boost household spending and retail sales. China has urged local authorities to help residents revamp their homes and ensure that people get better access to credit and direct cash to finance all kinds of household products.

Commerce Vice Minister Sheng Qiuping indicated that these moves are announced after the nation posted weaker-than-expected economic growth and consumer spending. Through this programme, the Chinese government also plans to guide e-commerce platforms and companies manufacturing home-related products to enter rural areas and offer renovation services at reasonable costs.

Small and medium firms

According to a joint statement by the finance minister and the Central bank in early August, China would encourage financial institutions to offer targeted and diversified lending support to some small and medium-sized manufacturers. According to the statement, “Small and medium-sized enterprises in key industrial sectors will also be offered appropriate products for foreign exchange hedging.”

Taxpayers with monthly sales revenue of less than 100,000 yuan will remain exempt from value-added tax (VAT), according to the statement. Micro and small businesses, as well as self-employed individuals, would continue to benefit from a 1% VAT rate, compared to a previous 3% rate.

Even the lenders’ earnings from loan interest and guarantee fees from these small business entities would remain VAT-free. Also, their loan contracts would continue to be exempt from stamp duty.

Earlier in March 2023, China issued a preferential tax policy for small firms and household businesses. China announced a 20% income tax for small firms with annual sales not exceeding 1 mn yuan ($145,340.39), as against the standard 25% rate. This is effective from the start of 2023 to the end of 2024.

The ministry also clarified that the annual taxable income of these small firms availing this rate must not exceed three mn yuan, the number of employees should be up to 300, and there should be maximum total assets of 50 mn yuan. China further stated that it would halve personal income tax for household businesses with annual sales not exceeding one mn yuan.

These supportive measures by the Chinese policymakers are likely to boost market sentiment, but the real test lies in their effective implementation.

Australia

Australia China

China India

India Indonesia

Indonesia Japan

Japan Malaysia

Malaysia Philippines

Philippines Singapore

Singapore South Korea

South Korea Taiwan

Taiwan Thailand

Thailand Vietnam

Vietnam

Germany

Germany Hong Kong

Hong Kong USA

USA Switzerland

Switzerland Singapore

Singapore

United Kingdom

United Kingdom Other / International

Other / International