Artificial intelligence is considered the next frontier in technological development thanks to its wide applications and reduced human effort. With the new popularity of OpenAI’s ChatGPT, now also China AI stocks come into focus as several companies in the country are trying to compete with the chatbot which can write essays, poetry and even generate articles.

China has a sophisticated and thriving AI industry. “China’s AI investment is expected to reach US$26.69 bn in 2026, accounting for about 8.9% of global investment, ranking second in the world among other countries,” as per a report by the International Data Corporation (IDC).

Some of the top applications for AI in China include — professional services, government, finance and telecom — which the IDC sees collectively exceeding 60% of the total spending in China’s AI market.

Developments in the Chinese AI sector

While the ChatGPT frenzy has drawn attention to AI on a commercial scale, OpenAI has not released the chatbot in China. “By 2030, AI could disrupt transportation and other key sectors in China, adding significant economic value—but only if strategic cooperation and capability building occur across multiple dimensions,” says McKinsey, pegging the total value addition at about $600 bn.

Earlier this month, a report released by CSET, a tech policy group at US-based Georgetown University, found that US companies had invested heavily in China AI stocks from 2015 to 2021. As many as 167 US investors were part of 401 transactions, roughly 17% of all investments made in Chinese AI firms. The amount raised through these deals was $40.2 bn, 37% of the total capital raised by AI firms in China.

Some of the major investors include Intel, Qualcomm and GGV Capital. However, the US has been trying to put block investments in China and the AI sector may also be affected, just as the semiconductor sector.

Although ChatGPT is currently seeing a lot of interest, a Nikkei study found that China is the undisputed champion when it comes to AI research. China’s Tencent, Alibaba and Huawei are among the top 10 companies researching AI. In 2021, China produced 43,000 papers on artificial intelligence, nearly twice as much as the US. The study also looked into the most-cited papers, and Chinese research topped the US papers by nearly 70%.

A recent report published by state media Xinhua said that Beijing alone had some 1,048 AI companies as of October 2022, accounting for 29% of the total number of AI firms in the country. The capital city is also supporting enterprises, research institutes, open-source communities and others for core AI technology innovation.

China AI stocks leading the charge

The popularity gained by ChatGPT has led to several big companies in China to announce their plans for similar or better AI initiatives. China AI stocks have seen a sudden jump in their share prices despite the fact that there are no immediate plans to release any ChatGPT-like AI anytime soon.

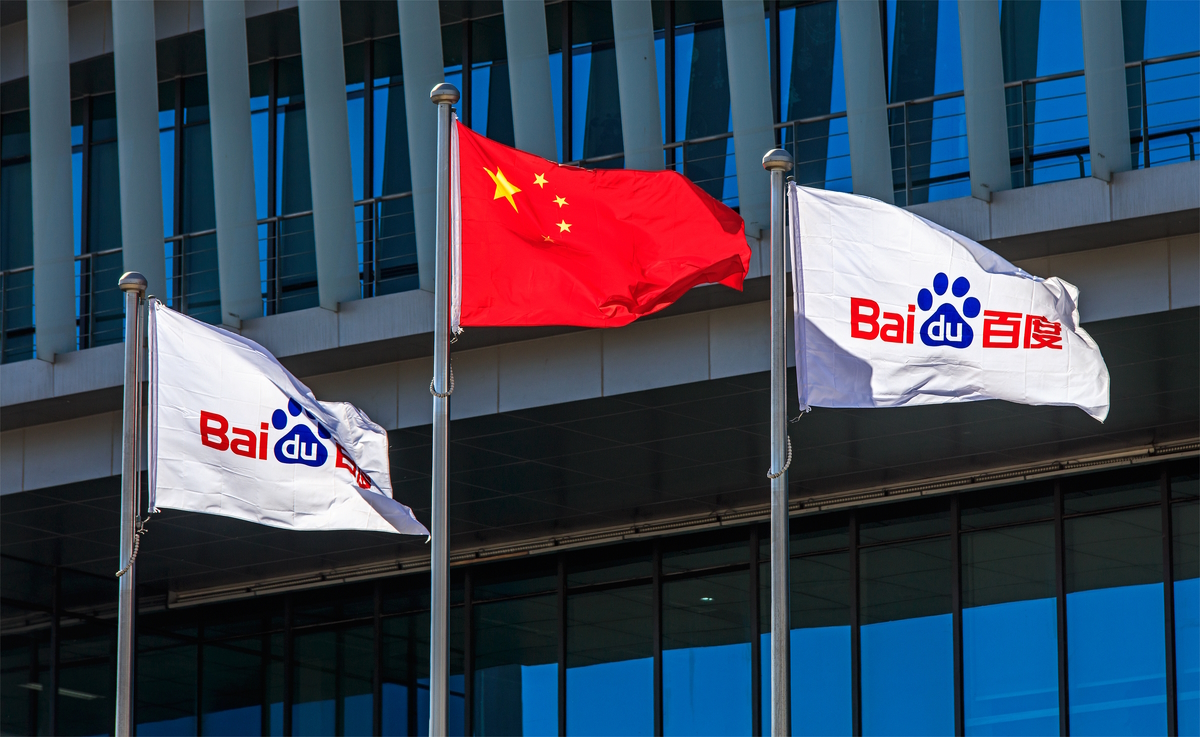

The only product which may come close is search engine giant Baidu’s ‘ERNIE bot’ due to be released in March. The company’s stock surged over 15% on February 7 after it announced the release of its chatbot. The company has not yet clarified what the front end of ERNIE will look like or if it will be integrated into the search engine.

Alibaba Group, China’s top e-commerce firm, said that it is testing a ChatGPT-style tool. Speculations are that Alibaba will pair the chatbot with its communication app DingTalk. Alibaba’s competitor JD.com too announced last week that it is planning to introduce a similar service such as ChatGPT. Called ChatJD, the industrial bot will help businesses with content generation, livestream e-commerce, and customer service in finance and retail. However, neither Alibaba nor JD.com have announced a date for the launch of their AI tools.

Separately, Chinese luxury e-commerce retail platform Secoo, listed on NASDAQ, said it will “conduct in-depth research and expansion on AI Generated Content and ChatGPT technology”.

Gaming giant NetEase, which is already using AI for creating 3D models of gamers and has an AI music creation platform, said it is developing a generative AI for its search engine Youdao. The company said it plans to release a demo soon but did not provide any timeline.

Some other stocks which saw a jump in their share prices include Hanwang Technology Co, TRS Information Technology Co, Beijing Haitian Ruisheng Science Technology Ltd, and Cloudwalk Technology Co. The CSI Artificial Intelligence Industry Index, which includes companies such as state-owned AI firm iFlytek, has risen over 17% in 2023, compared to a 5.29% rise in the CSI 300 Index.

However, after the initial jump in late January and early February, several of these China AI stocks have retreated from high valuations. Chinese state-owned media Securities Times recently published a front-page editorial which said that the surge in China AI stocks is similar to the hype of 5G, augmented reality, virtual reality and anti-virus garments, with interest eventually dying down.

Australia

Australia China

China India

India Indonesia

Indonesia Japan

Japan Malaysia

Malaysia Philippines

Philippines Singapore

Singapore South Korea

South Korea Taiwan

Taiwan Thailand

Thailand Vietnam

Vietnam

Germany

Germany Hong Kong

Hong Kong USA

USA Switzerland

Switzerland Singapore

Singapore

United Kingdom

United Kingdom Other / International

Other / International